Your 338 h 10 election example images are ready. 338 h 10 election example are a topic that is being searched for and liked by netizens now. You can Get the 338 h 10 election example files here. Download all royalty-free vectors.

If you’re looking for 338 h 10 election example images information connected with to the 338 h 10 election example topic, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for refferencing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

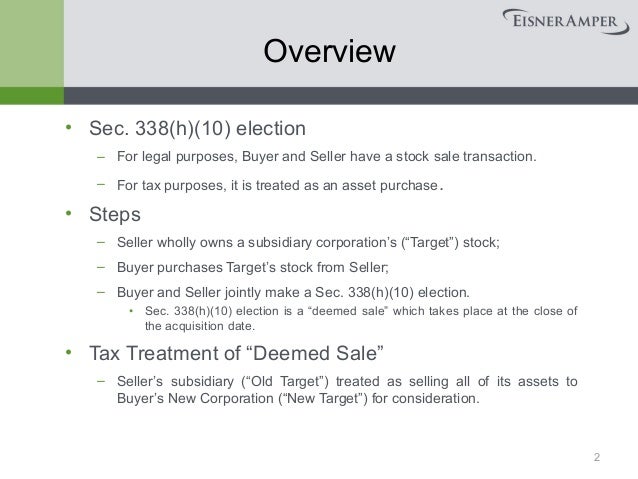

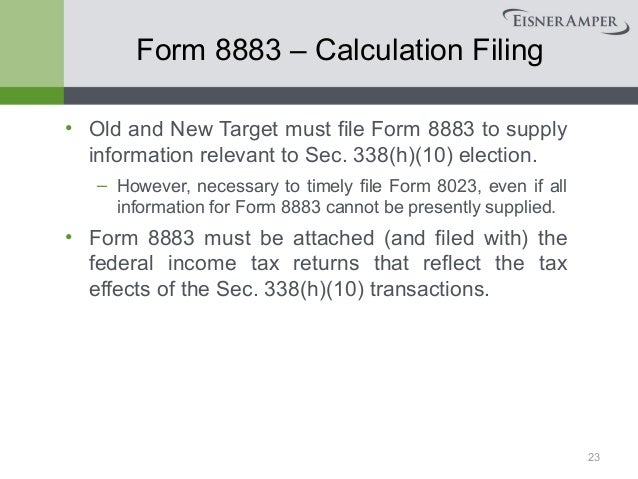

338 H 10 Election Example. Section 338h10 Internal Revenue Code Section. 11361-1l2v Example 7. A Section 338h10 election may be made for a target corporation if a purchasing corporation has made a qualified stock purchase QSP of a target corporation from a selling consolidated group a selling affiliate as defined in Treasury Regulations 1338h10-1b3 or S-corporation shareholders. 1338h10-1d8 makes the Sec.

Complex Deals Class 10 M A Tax Issues And Acquisition Accounting Ppt Download From slideplayer.com

Complex Deals Class 10 M A Tax Issues And Acquisition Accounting Ppt Download From slideplayer.com

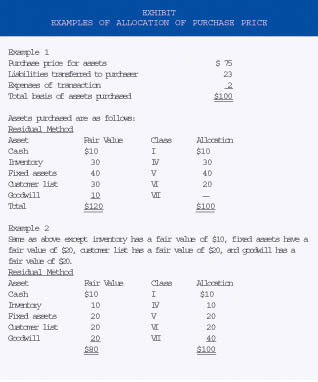

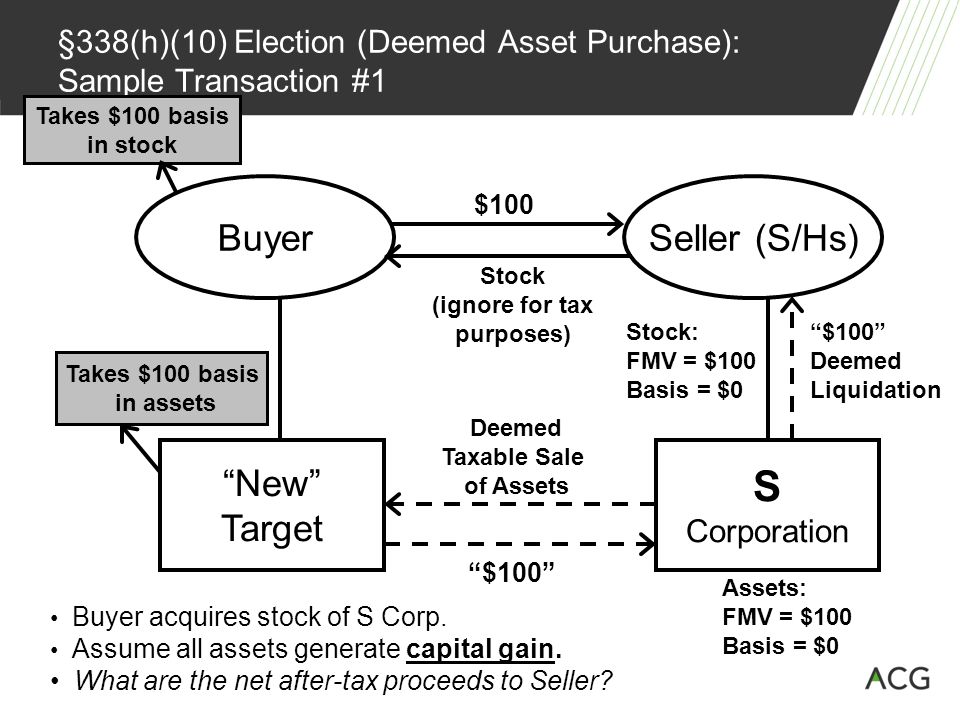

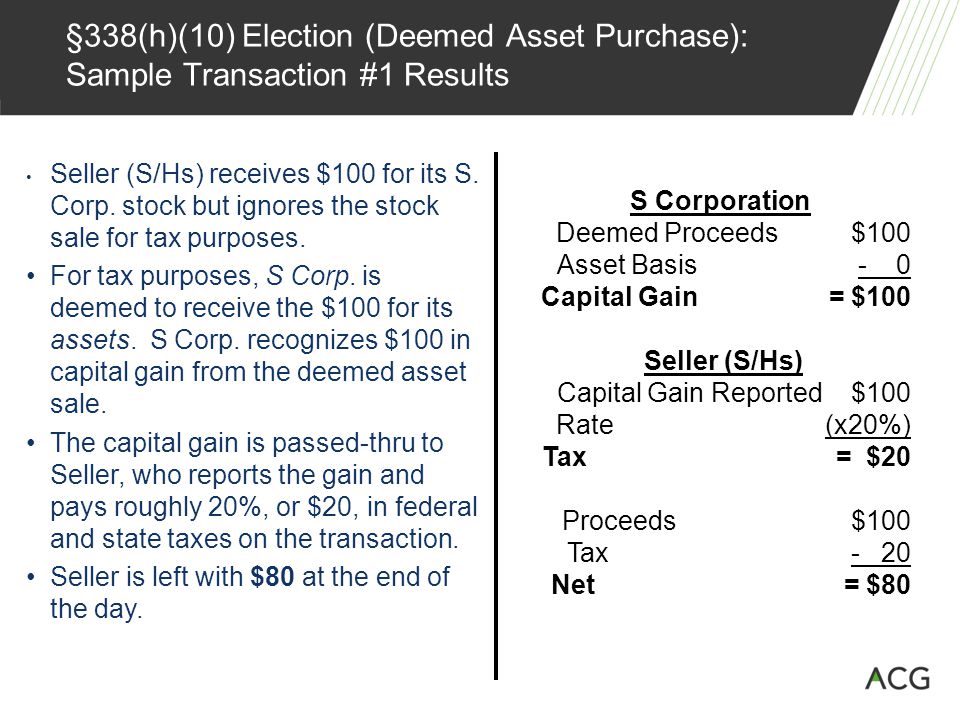

Target S is a C corporation and a member of a consolidated group with assets consisting of inventory with a pretransaction tax basis of 10 and value of 30. A 338h10 election allows a buyer of stock of an S corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100 of the assets of the target for tax purposes. A Section 338h10 election may be made for a target corporation if a purchasing corporation has made a qualified stock purchase QSP of a target corporation from a selling consolidated group a selling affiliate as defined in Treasury Regulations 1338h10-1b3 or S-corporation shareholders. Section 338h10 of the Internal Revenue Code can provide significant tax benefits to a buyer of 80 or more of a target corporation. Examples Deep Dive Materials Relevance of Pre-IRC338 law Kimbell-Diamond Historical Perspective oStatutes and regulations. The following example demonstrates the typical application of the AGUB allocation rules to a corporation making a Sec.

338h10 the Section 338 election provides a particu-lar federal income tax advan-tage in transactions involving the sale of S corporation equi-ty when compared to the sale of the C corporation equity.

Target S is a C corporation and a member of a consolidated group with assets consisting of inventory with a pretransaction tax basis of 10 and value of 30. Why Buyers Prefer 338h10 Elections. The S corporation equity but. Join us for our monthly live webinars from different staff members at The Center. IRC Section 338h10 Election Strategies for Tax Counsel Leveraging the Election in Structuring Acquisitions Dispositions Asset and Stock Transfers. The buyer can receive a step-up in basis either by making a Section 338h10 election or by acquiring a single member LLC interest in the case where the Transferor Corporation has become a limited liability company LLC through a state law conversion.

Source: slideshare.net

Source: slideshare.net

A Section 338h10 election may be made for a target corporation if a purchasing corporation has made a qualified stock purchase QSP of a target corporation from a selling consolidated group a selling affiliate as defined in Treasury Regulations 1338h10-1b3 or S-corporation shareholders. When some or all of the target stock is sold for an installment obligation and a Sec. A company is being sold with the following values. Management Rollovers338h10 Trap If the rollover is too large in amount expressed as a percentage of Targets equity which will be adjusted by a deemed redemption addressed above it may not be possible to make a 338h10 election. For example if there is a 30 rollover there can be no purchase of 80 of Targets stock.

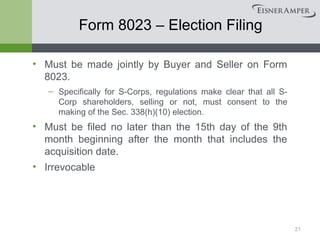

Section 338h10 of the Internal Revenue Code can provide significant tax benefits to a buyer of 80 or more of a target corporation. A Section 338g election results in both corporate and shareholder level tax. The buyer and seller all stockholders must jointly make the election it cannot be unilaterally made by one side. A Upon Buyers request Seller and Buyer shall join in making a timely and irrevocable election under Code 338h10 and any corresponding elections under state Tax Law collectively the Section 338h10 Election with respect to the purchase and sale of the Shares of Company. Buyers tend to prefer 338h10 elections more than sellers do since it is the buyer that benefits from the step up in cost basis and the ability to depreciate and amortize.

Source: archives.cpajournal.com

Source: archives.cpajournal.com

A Section 338h10 election may be made for a target corporation if a purchasing corporation has made a qualified stock purchase QSP of a target corporation from a selling consolidated group a selling affiliate as defined in Treasury Regulations 1338h10-1b3 or S-corporation shareholders. A 338h10 election allows a buyer of stock of an S corporation or a corporation within a consolidated group to treat the transaction as an acquisition of 100 of the assets of the target for tax purposes. When some or all of the target stock is sold for an installment obligation and a Sec. Parts III-VIII provide a more detailed analysis of the operation and effect of section 338h10. These elections treat a stock acquisition as an asset acquisition for federal income tax purposes.

Source: slideplayer.com

Source: slideplayer.com

If various conditions are met the election allows the parties in a sale of stock of a corporation to treat the transaction for federal income tax purposes as. This September we will be covering 338 h10 elections when and how to. A section 338h10 election refers to an election under section 338h10 of the federal tax code. The section 338h10 election must be made not later than the 15th day of the 9th month beginning after the month in which the acquisition date occurs. 11361-1l2v Example 7.

Source: present5.com

Source: present5.com

Seller must be either a US. The buyer and seller all stockholders must jointly make the election it cannot be unilaterally made by one side. Except as otherwise noted in this outline T or target. Join us for our monthly live webinars from different staff members at The Center. Management Rollovers338h10 Trap If the rollover is too large in amount expressed as a percentage of Targets equity which will be adjusted by a deemed redemption addressed above it may not be possible to make a 338h10 election.

Source: slideplayer.com

Source: slideplayer.com

Join us for our monthly live webinars from different staff members at The Center. A Buyer and Seller agree to jointly make the election permitted by Section 338 h 10 the 338 h 10 Election of the Code and if required by Law or if Buyer so requests such other elections as may be required under corresponding provisions of foreign state local or other income tax Law to. The so-called regular Section 338 election under Section 338 g and the other under Section 338 h 10. 338 h 10 Election Example. 11361-1l2v Example 7.

Source: slideshare.net

Source: slideshare.net

Section 338h10 Internal Revenue Code Section. S which has always been an S corporation has two individual shareholders A who owns 70 and B who owns 30. Part II provides an example of a typical acquisition in which a section 338h10 election might be made and analyzes the results. P the purchasing corporation pays cash to Ss shareholders for all the S stock. A 338h10 election allows a.

Source: slideplayer.com

Source: slideplayer.com

Why Buyers Prefer 338h10 Elections. A Section 338h10 election can be made when one corporation purchases the stock of another corporation and the election must be made jointly by the buyer and the seller. 1338h10-1d8 makes the Sec. A company is being sold with the following values. Seller must be either a US.

338h10 the Section 338 election provides a particu-lar federal income tax advan-tage in transactions involving the sale of S corporation equi-ty when compared to the sale of the C corporation equity. A Section 338h10 election can be made when one corporation purchases the stock of another corporation and the election must be made jointly by the buyer and the seller. A 338h10 election allows a. For legal purposes a 338 h 10 election remains a stock sale despite being deemed an asset. IRC Section 338h10 Election Strategies for Tax Counsel Leveraging the Election in Structuring Acquisitions Dispositions Asset and Stock Transfers.

Source: youtube.com

Source: youtube.com

A Section 338g election results in both corporate and shareholder level tax. A Section 338h10 election may be made for a target corporation if a purchasing corporation has made a qualified stock purchase QSP of a target corporation from a selling consolidated group a selling affiliate as defined in Treasury Regulations 1338h10-1b3 or S-corporation shareholders. If a section 338h10 election is made for T a section 338 election is deemed made for T. Management Rollovers338h10 Trap If the rollover is too large in amount expressed as a percentage of Targets equity which will be adjusted by a deemed redemption addressed above it may not be possible to make a 338h10 election. 338h10 the Section 338 election provides a particu-lar federal income tax advan-tage in transactions involving the sale of S corporation equi-ty when compared to the sale of the C corporation equity.

Source: slideplayer.com

Source: slideplayer.com

For example if there is a 30 rollover there can be no purchase of 80 of Targets stock. A section 338h10 election refers to an election under section 338h10 of the federal tax code. IRC Section 338h10 Election Strategies for Tax Counsel Leveraging the Election in Structuring Acquisitions Dispositions Asset and Stock Transfers. 1338h10-1d8 makes the Sec. Relief under IRC 1362f is available if among other requirements the S election was.

Source: slidetodoc.com

Source: slidetodoc.com

Relief under IRC 1362f is available if among other requirements the S election was. Section 338h10 of the Internal Revenue Code can provide significant tax benefits to a buyer of 80 or more of a target corporation. Except as otherwise noted in this outline T or target. P and Ss. 11361-1l2v Example 7.

Source: slidetodoc.com

Source: slidetodoc.com

Limitations of 338 h 10 election. Corporate subsidiary of a parent company or an S-Corporation. If the facts do not satisfy Example 7 consider a private letter ruling under IRC 1362f. Section 338h10 Internal Revenue Code Section. The deemed asset sale for.

Source: slidetodoc.com

Source: slidetodoc.com

A company is being sold with the following values. A Section 338 election is useful when the buyer has a good business reason to acquire stock. A 338h10 election allows a. P and Ss. S which has always been an S corporation has two individual shareholders A who owns 70 and B who owns 30.

Source: tax.ohio.gov

Source: tax.ohio.gov

The buyer can receive a step-up in basis either by making a Section 338h10 election or by acquiring a single member LLC interest in the case where the Transferor Corporation has become a limited liability company LLC through a state law conversion. The buyer and seller all stockholders must jointly make the election it cannot be unilaterally made by one side. 338 h 10 Election Example. S which has always been an S corporation has two individual shareholders A who owns 70 and B who owns 30. Determine if facts fit within Treas.

Source: slideshare.net

Source: slideshare.net

Section 338h10 of the Internal Revenue Code can provide significant tax benefits to a buyer of 80 or more of a target corporation. Determine if facts fit within Treas. A Buyer and Seller agree to jointly make the election permitted by Section 338 h 10 the 338 h 10 Election of the Code and if required by Law or if Buyer so requests such other elections as may be required under corresponding provisions of foreign state local or other income tax Law to. A Section 338h10 election results only in corporate level tax The two levels of tax that attend a Section 338g election render it uneconomic in all but a limited set of circumstances. S which has always been an S corporation has two individual shareholders A who owns 70 and B who owns 30.

Source: slideshare.net

Source: slideshare.net

Why Buyers Prefer 338h10 Elections. The so-called regular Section 338 election under Section 338 g and the other under Section 338 h 10. The section 338h10 election must be made not later than the 15th day of the 9th month beginning after the month in which the acquisition date occurs. If various conditions are met the election allows the parties in a sale of stock of a corporation to treat the transaction for federal income tax purposes as. A Buyer and Seller agree to jointly make the election permitted by Section 338 h 10 the 338 h 10 Election of the Code and if required by Law or if Buyer so requests such other elections as may be required under corresponding provisions of foreign state local or other income tax Law to.

Source: slideplayer.com

Source: slideplayer.com

Cost basis or original asset value for tax purposes. Section 338h10 Internal Revenue Code Section. The so-called regular Section 338 election under Section 338 g and the other under Section 338 h 10. A section 338h10 election refers to an election under section 338h10 of the federal tax code. 453 installment-sale method of accounting available to Old T provided the deemed asset sale would otherwise qualify for installment-sale reporting.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 338 h 10 election example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.