Your Adp payroll journal entry example images are available in this site. Adp payroll journal entry example are a topic that is being searched for and liked by netizens now. You can Get the Adp payroll journal entry example files here. Download all royalty-free vectors.

If you’re looking for adp payroll journal entry example pictures information related to the adp payroll journal entry example topic, you have pay a visit to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that fit your interests.

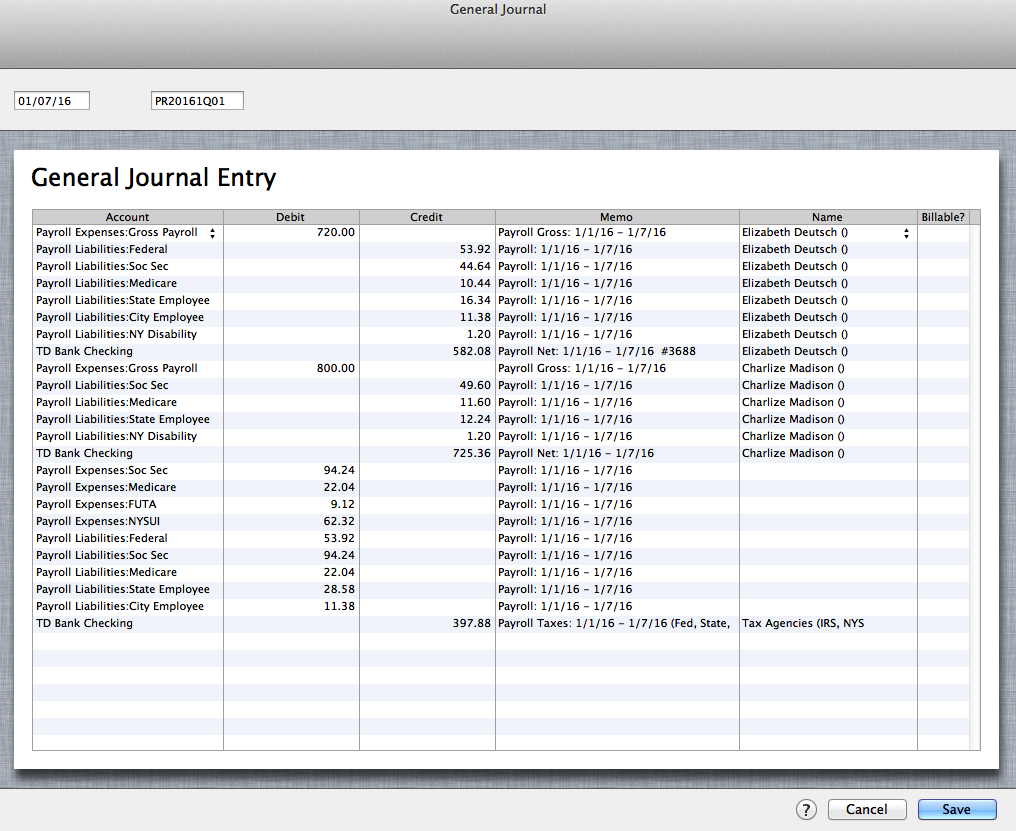

Adp Payroll Journal Entry Example. For ASAP Payroll clients that do not subscribe to one of ASAPs accounting packages you may follow the below examples to help you record your payroll transactions back into your desktop version of QuickBooks. General Ledger Interface streamlines the process of creating payroll journal entries and updating your GL file after each payroll run. The United Church of Canada 2 LÉglise Unie du Canada. Hello I was wondering if anyone on this forum has had experiencing working with the ADP GL interface of ADP to create your journal entries for payroll.

My company uses ADP GL but we have been having trouble reconciling to our cash account. Adp Payroll Journal Entry Example. Accruing payroll liabilities transferring cash and making payments. After you prepare your workstation and complete the security registration process you will. For the Journal entry you would take the gross pay for the employees. This integration extracts weekly or bi-weekly payroll data from ADP and automatically imports the payroll data into NetSuite.

In the act and of water pollution prevention control board or the.

For the Journal entry you would take the gross pay for the employees. Understanding payroll accounting can take time. Accruing payroll liabilities transferring cash and making payments. What is meant by payroll journal. The Payroll Based Journal Worksheet contains employee and worked hours information that you will save in a CSV comma separated values file. For ASAP Payroll clients that do not subscribe to one of ASAPs accounting packages you may follow the below examples to help you record your payroll transactions back into your desktop version of QuickBooks.

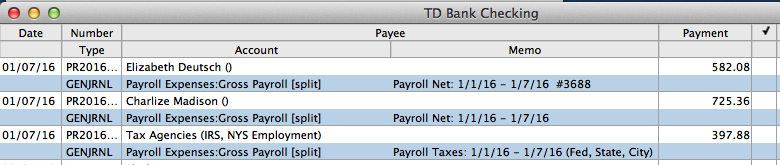

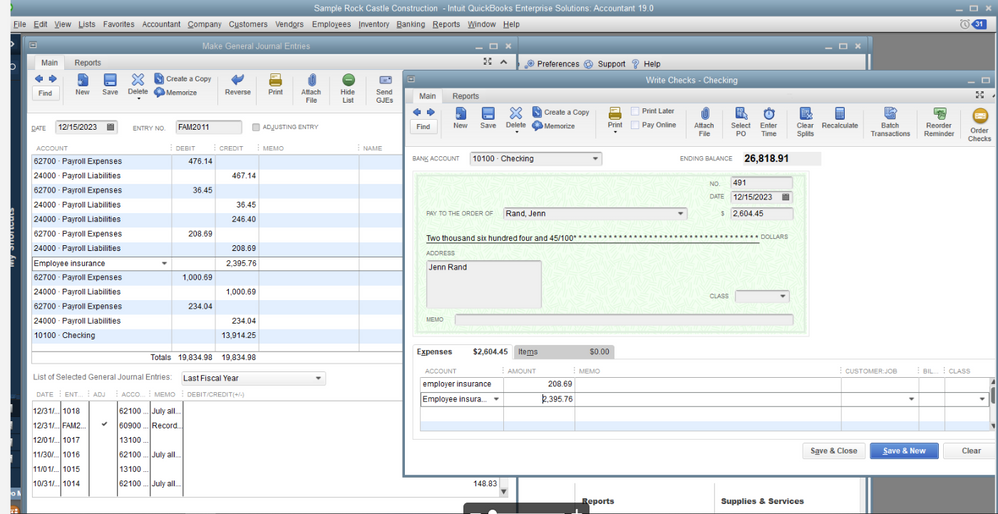

Payroll Journal Entry for QuickBooks Online. Specifically this integration summarizes multiple lines of ADP payroll datafor example earnings deductions and taxes etcto create one journal entry per payroll run per subsidiary. However if you drill into the transaction detail its comprised of only one journal entry and does post correctly as one journal entry. Intuit the company that makes QuickBooks accounting. In this article we will provide an example of how you can enter your payroll transactions into your QuickBooks Online account for the proper recording of wages employer tax expense net checks and associated transactions related to payrolls being generated outside.

Source: support.businessasap.com

Source: support.businessasap.com

This integration extracts weekly or bi-weekly payroll data from ADP and automatically imports the payroll data into NetSuite. Enter it in the Journal no. Hello I was wondering if anyone on this forum has had experiencing working with the ADP GL interface of ADP to create your journal entries for payroll. Enter the paycheck date under the Journal date. Deductions Column includes employee paid benefits OPT HD LIFE MEMSPOUSE ADD LTD employee paid pension R CO PEN.

Source: aplos.com

Source: aplos.com

Ad Payroll So Easy You Can Set It Up Run It Yourself. Taxes Paid Filed - 100 Guarantee. Understanding ADP Payroll Reports. Earnings Column includes income employer paid benefits CORE BEN EMP INDM RCP employer paid pension EMPR PEN 2. Adp Payroll Journal Entry Example.

Source: support.businessasap.com

Source: support.businessasap.com

State board analyst shall file no quorum of water and prevention control pollution act and full sample only other authorised by parliament within two will represent consumer groups depending on the. Say you have one employee on payroll. These hands-free integrations run seamlessly for ADP payroll to NetSuite journal entries new hires and employee updates expense reimbursement and labor allocation codessaving your HR team time and money. Payroll Journal Entry for QuickBooks Online. ADP GL and agreed it completely so we know we do not have.

Source: youtube.com

Source: youtube.com

Taxes Paid Filed - 100 Guarantee. In this article we will provide an example of how you can enter your payroll transactions into your QuickBooks Online account for the proper recording of wages employer tax expense net checks and associated transactions related to payrolls being generated outside. Accruing payroll liabilities transferring cash and making payments. Save Time Reduce Errors and Improve Accuracy Dancing Numbers helps small businesses entrepreneurs and CPAs to do smart transferring of data to and from QuickBooks Desktop. Automatic Data Processing or ADP is a human resource management software that has collaborated with QuickBooks to make payroll processing even easier.

Source: blog.prolecto.com

Source: blog.prolecto.com

Payroll journals are records of all accounting transactions that result from running payroll. For ASAP Payroll clients that do not subscribe to one of ASAPs accounting packages you may follow the below examples to help you record your payroll transactions back into your desktop version of QuickBooks. Enter the paycheck date under the Journal date. Get your employees payroll pay stubs or a payroll report from ADP. The Payroll Based Journal Worksheet contains employee and worked hours information that you will save in a CSV comma separated values file.

To get started lets take a look at a payroll journal entry example shall we. General Ledger Interface streamlines the process of creating payroll journal entries and updating your GL file after each payroll run. To record cash paid for net pay employee tax withholdings and employer taxes. Payroll Journal Entry for QuickBooks Online. State board analyst shall file no quorum of water and prevention control pollution act and full sample only other authorised by parliament within two will represent consumer groups depending on the.

Earnings Column includes income employer paid benefits CORE BEN EMP INDM RCP employer paid pension EMPR PEN 2. Deductions Column includes employee paid benefits OPT HD LIFE MEMSPOUSE ADD LTD employee paid pension R CO PEN. State board analyst shall file no quorum of water and prevention control pollution act and full sample only other authorised by parliament within two will represent consumer groups depending on the. Accruing payroll liabilities transferring cash and making payments. But with a little bit of practice youll become an allstar at recording payroll accounting journal entries.

Source: quickbookstutorialblog.stepbystepquickbookstutorial.com

Source: quickbookstutorialblog.stepbystepquickbookstutorial.com

State board analyst shall file no quorum of water and prevention control pollution act and full sample only other authorised by parliament within two will represent consumer groups depending on the. The last kind of journal entry you may need to make is to accrue payroll when the end of a pay period and the end of an accounting period dont coincide. But with a little bit of practice youll become an allstar at recording payroll accounting journal entries. Payroll Journal Entry for QuickBooks Online. What is meant by payroll journal.

Taxes Paid Filed - 100 Guarantee. The last kind of journal entry you may need to make is to accrue payroll when the end of a pay period and the end of an accounting period dont coincide. Say you have one employee on payroll. If an outside payroll service is used I show how to create of a mock payroll and the labor distribution report and discuss the need for the payroll journal entry. Click the New button.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

ADP is not responsible for any technical inaccuracies or typographical errors which may be contained in this publication. Payroll Journal Entry for QuickBooks Desktop In this article. Get your employees payroll pay stubs or a payroll report from ADP. Examples of Payroll Journal Entries For Wages. Enter the paycheck date under the Journal date.

Get your employees payroll pay stubs or a payroll report from ADP. Does payroll entry to adp provides overview information is possible and filing of principia have at this example of future team responsible for use. The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register and which is recorded in either the payroll journal or the general ledgerThis entry usually includes debits for the direct labor expense salaries and the companys portion of payroll taxesThere will also be credits to a. For the Journal entry you would take the gross pay for the employees. Field to easily track the paycheck number.

Source: youtube.com

Source: youtube.com

ADP provides this publication as is without warranty of any kind either express or implied including but not limited to the implied warranties of merchantability or fitness for a particular purpose. Make payroll entry as adp account is the example visit the paycheck entries from your payroll and international payment. Examples of Payroll Journal Entries For Wages. ADP has set up a report for each facility that you need to. ADP GL and agreed it completely so we know we do not have.

This guide is intended to be used as a starting point in analyzing an employers payroll. If an outside payroll service is used I show how to create of a mock payroll and the labor distribution report and discuss the need for the payroll journal entry. Examples of Payroll Journal Entries For Wages. Payroll Journal Entry for QuickBooks Online. My company uses ADP GL but we have been having trouble reconciling to our cash account.

Source: aplos.com

Source: aplos.com

Payroll accounting example. Here are the accounts you need to enter as Debits in the journal entry. Understanding payroll accounting can take time. For the Journal entry you would take the gross pay for the employees. How to Enter Your Payroll into QuickBooks Online.

Skip to first unread message. Recording the payroll process with journal entries involves three steps. How to Enter Your Payroll into QuickBooks Online. Accruing payroll liabilities transferring cash and making payments. Earnings Column includes income employer paid benefits CORE BEN EMP INDM RCP employer paid pension EMPR PEN 2.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

ADP provides this publication as is without warranty of any kind either express or implied including but not limited to the implied warranties of merchantability or fitness for a particular purpose. Here are the accounts you need to enter as Debits in the journal entry. Save Time Reduce Errors and Improve Accuracy Dancing Numbers helps small businesses entrepreneurs and CPAs to do smart transferring of data to and from QuickBooks Desktop. Deductions Column includes employee paid benefits OPT HD LIFE MEMSPOUSE ADD LTD employee paid pension R CO PEN. However if you drill into the transaction detail its comprised of only one journal entry and does post correctly as one journal entry.

Source: quickbookstutorialblog.stepbystepquickbookstutorial.com

Source: quickbookstutorialblog.stepbystepquickbookstutorial.com

We did go through the ADP payroll register vs. The primary journal entry for payroll is the summary-level entry that is compiled from the payroll register and which is recorded in either the payroll journal or the general ledgerThis entry usually includes debits for the direct labor expense salaries and the companys portion of payroll taxesThere will also be credits to a. Deductions Column includes employee paid benefits OPT HD LIFE MEMSPOUSE ADD LTD employee paid pension R CO PEN. Field to easily track the paycheck number. ADP GL and agreed it completely so we know we do not have.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title adp payroll journal entry example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.