Your Double declining balance method example images are ready in this website. Double declining balance method example are a topic that is being searched for and liked by netizens now. You can Get the Double declining balance method example files here. Get all royalty-free photos.

If you’re searching for double declining balance method example images information linked to the double declining balance method example keyword, you have come to the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

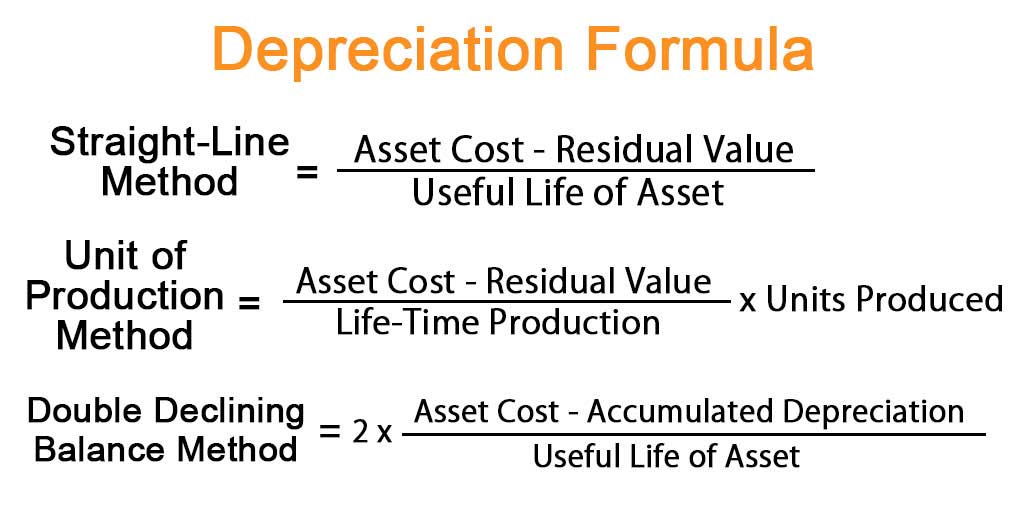

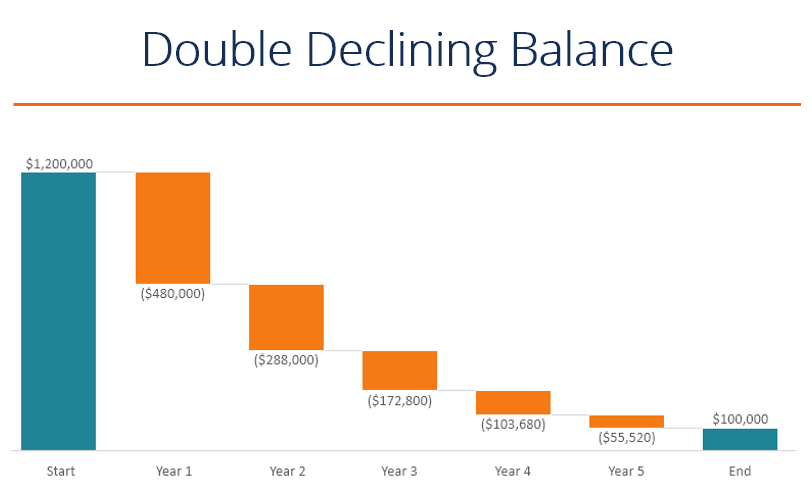

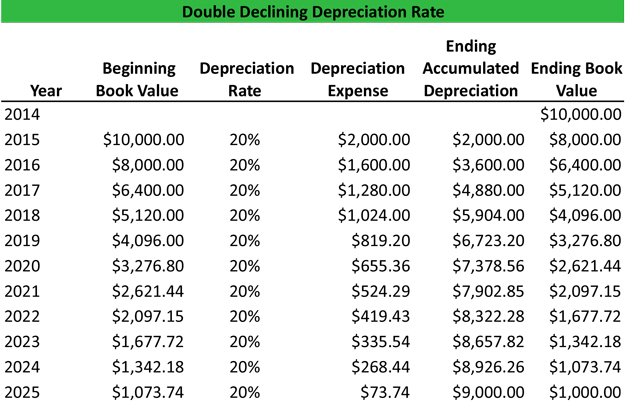

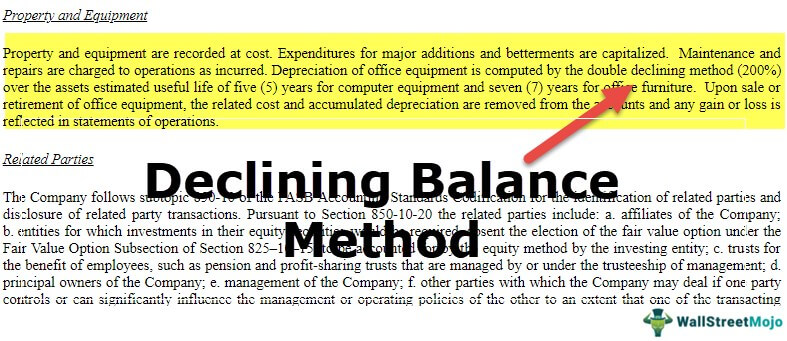

Double Declining Balance Method Example. At the end of their 10-year useful life it is expected that the fixtures will be worthless. Lets understand the same with the help of examples. First we need to calculate the depreciation expense for the first year. Double Declining Balance Method is one of the accelerated methods used for the calculation of the depreciation amount to be charged in the income statement of the company and it is calculated by multiplying the Book value of asset with Rate of depreciation as per straight-line method and 2.

How To Use The Excel Ddb Function Exceljet From exceljet.net

How To Use The Excel Ddb Function Exceljet From exceljet.net

The double-declining method DDB of depreciation is a technique that companies use to charge depreciation. Double-Declining Method Calculation Example. The estimated useful life is 10 years resulting in a straight-line depreciation rate of 10. The double declining balance method of depreciation also called accelerated depreciation method. At the end of their 10-year useful life it is expected that the fixtures will be worthless. The declining balance methodology is one of the 2 accelerated depreciation ways and it uses a rate thats some multiple of the straight-line method of depreciation rate.

Under IRS rules vehicles are depreciated over a 5 year recovery period.

So you just bought a new ice cream truck for your business. The double-declining method DDB of depreciation is a technique that companies use to charge depreciation. The double declining balance method of depreciation also called accelerated depreciation method. ABC Company purchases a machine for 100000. It means the scrap value is ignored while calculating the rate of depreciation. The double-declining-balance method is a depreciation method that bases the annual depreciation expense on.

Source: online-accounting.net

Source: online-accounting.net

Double Declining Balance Depreciation Formulas. Under IRS rules vehicles are depreciated over a 5 year recovery period. The double-declining balance DDB methodology may be a kind of declining balance methodology that instead uses double the conventional rate. Following are the examples are given below. Double Declining Balance Method is one of the accelerated methods used for the calculation of the depreciation amount to be charged in the income statement of the company and it is calculated by multiplying the Book value of asset with Rate of depreciation as per straight-line method and 2.

Source: youtube.com

Source: youtube.com

The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset has lost since a business acquired it. The double declining balance DDB method is a type of declining balance method that instead uses double the normal depreciation rate. The declining balance methodology is one of the 2 accelerated depreciation ways and it uses a rate thats some multiple of the straight-line method of depreciation rate. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value. The double-declining balance method is one of the depreciation methods used in entities nowadays.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

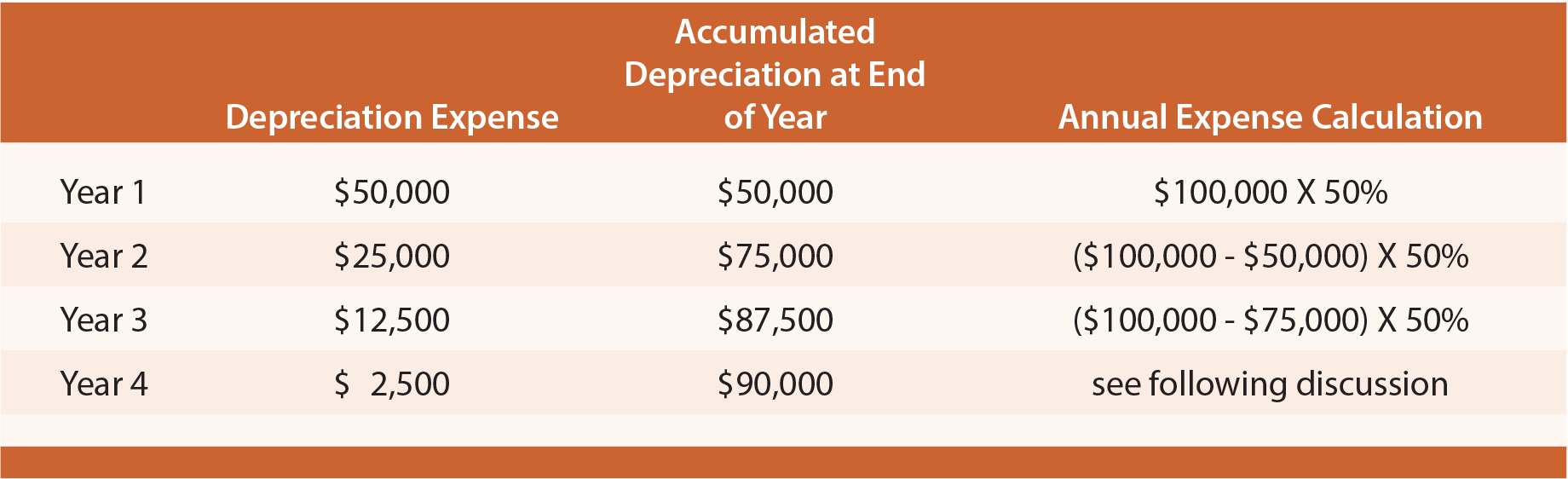

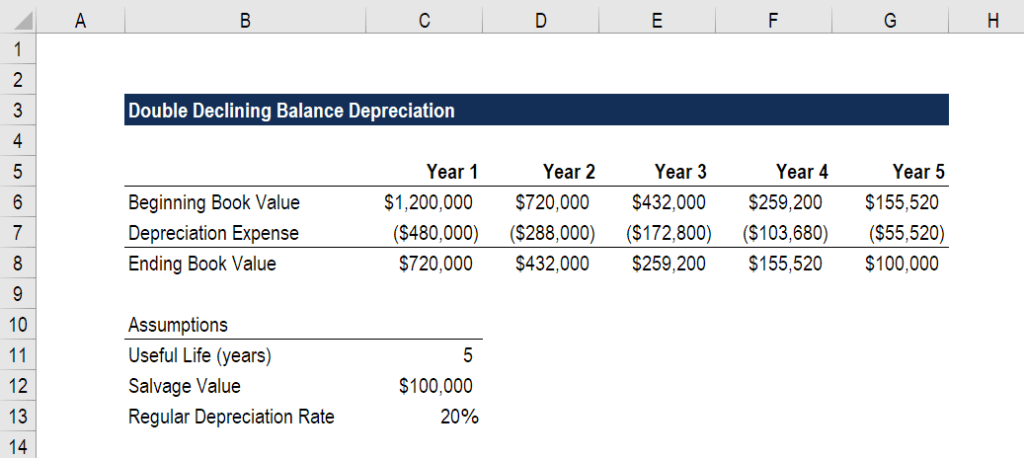

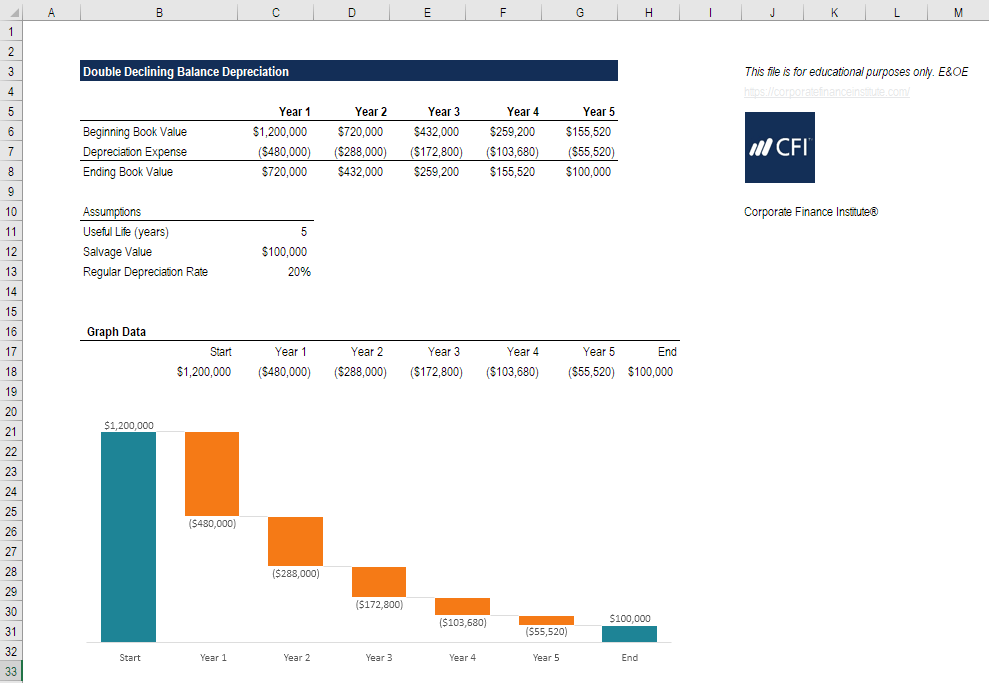

Its useful life is 5 years. Example of Double Declining Balance Method. The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset has lost since a business acquired it. Using this method the Book Value at the beginning of each period is multiplied by a fixed Depreciation Rate which is 200 of the straight line depreciation rate or a factor of 2. A variation on this method is the 150 declining balance method which substitutes 15 for the 20 figure used in the calculation.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The double declining balance DDB method is a type of declining balance method that instead uses double the normal depreciation rate. The double declining balance method is an accelerated depreciation method. A retailer purchased fixtures on January 1 at a cost of 100000. At the end of their 10-year useful life it is expected that the fixtures will be worthless. Johnsons cars bought equipment for 380500.

Source: calculatorsoup.com

Source: calculatorsoup.com

So using the double declining balance depreciation method the calculation goes as. The double-declining balance depreciation method uses accelerated depreciation that charges a higher expense initially. Examples of Declining Balance Method of Depreciation. The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset has lost since a business acquired it. Johnsons cars bought equipment for 380500.

Source: depreciationguru.com

Source: depreciationguru.com

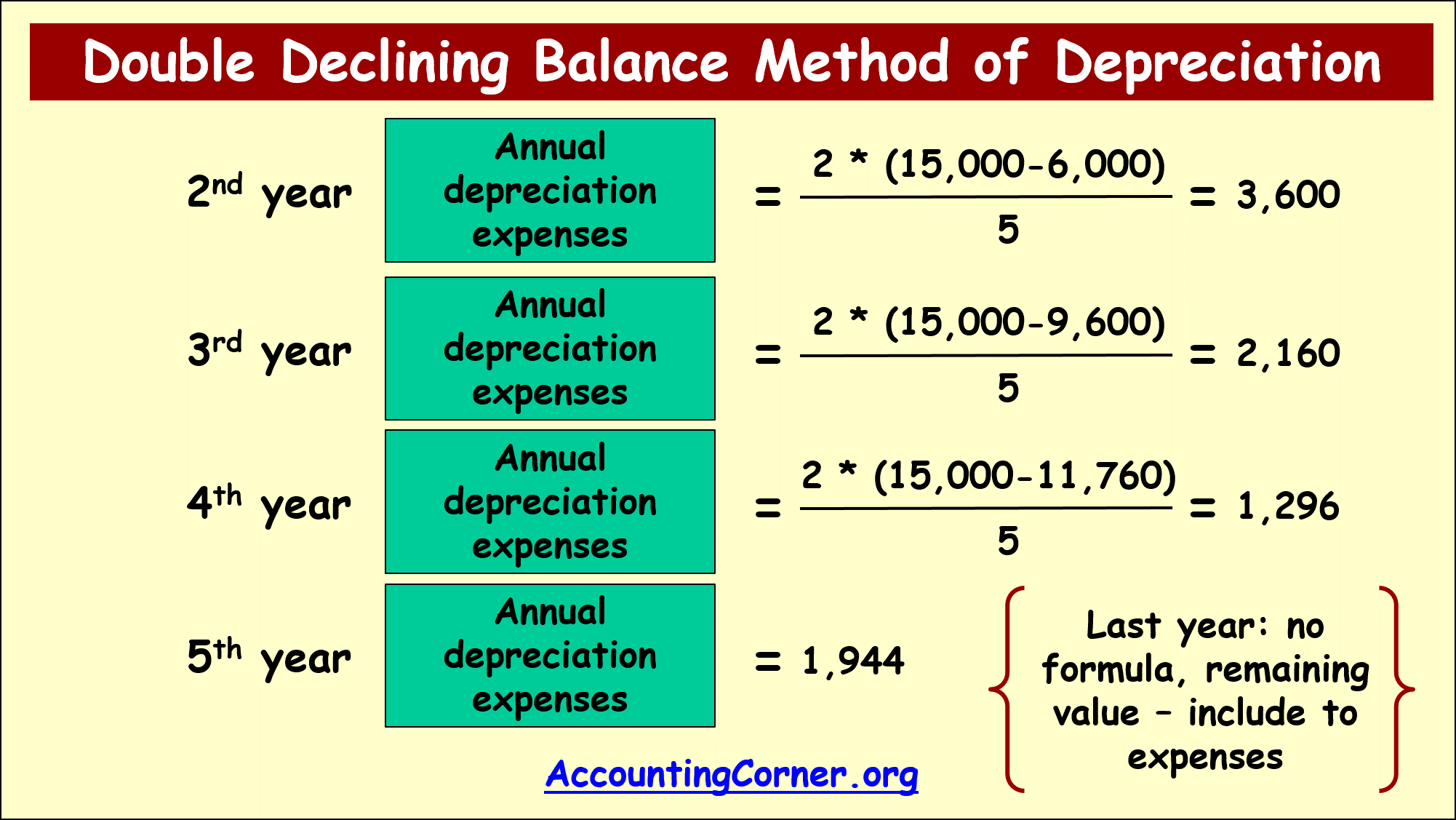

It was first enacted and authorized under the Internal Revenue Code in 1954 and it was a major change from existing policy. A retailer purchased fixtures on January 1 at a cost of 100000. Calculate depreciation for each year with respect to the machine. Lets calculate depreciation for the 2nd year using the double declining balance method. It is an accelerated depreciation method that depreciates the asset value at twice the rate in comparison to the depreciation rate used in the straight-line method.

Source: youtube.com

Source: youtube.com

Using this method the Book Value at the beginning of each period is multiplied by a fixed Depreciation Rate which is 200 of the straight line depreciation rate or a factor of 2. The van purchase price is 1000. Declining Balance Method Example. Lets understand the same with the help of examples. The double declining balance method of depreciation also called accelerated depreciation method.

Source: double-entry-bookkeeping.com

Source: double-entry-bookkeeping.com

Now youre going to write it off your taxes using the double depreciation balance method. Double Declining Balance Depreciation Formulas. Fedcorp Industries made a purchase of a delivery van to transport merchandise. At the end of their 10-year useful life it is expected that the fixtures will be worthless. Example of Double-Declining-Balance Depreciation.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

A variation on this method is the 150 declining balance method which substitutes 15 for the 20 figure used in the calculation. Declining Balance Method Example. Use the following formula to calculate double-declining depreciation rate. First we need to calculate the depreciation expense for the first year. Its useful life is 5 years.

Source: efinancemanagement.com

Source: efinancemanagement.com

Johnsons cars bought equipment for 380500. The van purchase price is 1000. The double declining balance depreciation method is generally used when an asset is depreciating at a faster rate at the beginning of its lifespan or where the organization intends to shift profits further into the future by accounting for larger amounts of depreciation at the beginning of the assets life span. Depreciation rates used in the declining balance method could. A variation on this method is the 150 declining balance method which substitutes 15 for the 20 figure used in the calculation.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

It represents the amount of. The double-declining method DDB of depreciation is a technique that companies use to charge depreciation. Depreciation rates used in the declining balance method could. Use the following formula to calculate double-declining depreciation rate. First we need to calculate the depreciation expense for the first year.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

The van purchase price is 1000. Double-declining Depreciation Rate Straight-line Depreciation Rate x 2. Examples of Declining Balance Method of Depreciation. At the end of their 10-year useful life it is expected that the fixtures will be worthless. Assume a retailer purchases fixtures on January 1 at a cost of 100000.

Source: dailybusinessguide.com

Source: dailybusinessguide.com

According to the straight-line method an assets annual depreciation will be 10 of the assets cost over a 10-year period. It was first enacted and authorized under the Internal Revenue Code in 1954 and it was a major change from existing policy. This method takes most of the depreciation charges upfront in the early years lowering profits on the income statement sooner rather than later. The double declining balance method of depreciation also called accelerated depreciation method. Johnsons cars bought equipment for 380500.

Source: accountingcorner.org

Source: accountingcorner.org

So you just bought a new ice cream truck for your business. Double Declining Balance Method is one of the accelerated methods used for the calculation of the depreciation amount to be charged in the income statement of the company and it is calculated by multiplying the Book value of asset with Rate of depreciation as per straight-line method and 2. Depreciation rates used in the declining balance method could. Example of Double Declining Balance Depreciation. This method takes most of the depreciation charges upfront in the early years lowering profits on the income statement sooner rather than later.

Source: exceljet.net

Source: exceljet.net

The double declining balance method of depreciation also called accelerated depreciation method. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a residual value Residual Value Residual value is the estimated scrap value of an asset at the end of its lease or useful life also known as the salvage value. Lets understand the same with the help of examples. The estimated useful life is 10 years resulting in a straight-line depreciation rate of 10. In this depreciation method first fall the straight-line depreciation rate is determined just dividing the original cost by its life.

Source: accountingcorner.org

Source: accountingcorner.org

The double-declining balance method is one of the depreciation methods used in entities nowadays. The double-declining balance depreciation method uses accelerated depreciation that charges a higher expense initially. Under IRS rules vehicles are depreciated over a 5 year recovery period. Example of Double Declining Balance Method. The double-declining method DDB of depreciation is a technique that companies use to charge depreciation.

Source: pakaccountants.com

Source: pakaccountants.com

The double-declining balance method also called the 200 declining balance method is a common method for calculating accumulated depreciation or the value an asset has lost since a business acquired it. The double declining balance depreciation method is generally used when an asset is depreciating at a faster rate at the beginning of its lifespan or where the organization intends to shift profits further into the future by accounting for larger amounts of depreciation at the beginning of the assets life span. This method takes most of the depreciation charges upfront in the early years lowering profits on the income statement sooner rather than later. Depreciation methods like DDB allow businesses to distribute the cost of an asset over as many accounting periods as the asset remains useful. The estimated useful life is 10 years resulting in a straight-line depreciation rate of 10.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Double Declining Balance Depreciation Method. A retailer purchased fixtures on January 1 at a cost of 100000. The double-declining method DDB of depreciation is a technique that companies use to charge depreciation. Fedcorp also determines that the vans. Following are the examples are given below.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title double declining balance method example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.