Your Example of completed r185 form images are available. Example of completed r185 form are a topic that is being searched for and liked by netizens now. You can Find and Download the Example of completed r185 form files here. Find and Download all royalty-free photos.

If you’re looking for example of completed r185 form images information related to the example of completed r185 form topic, you have pay a visit to the right blog. Our site always gives you hints for viewing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

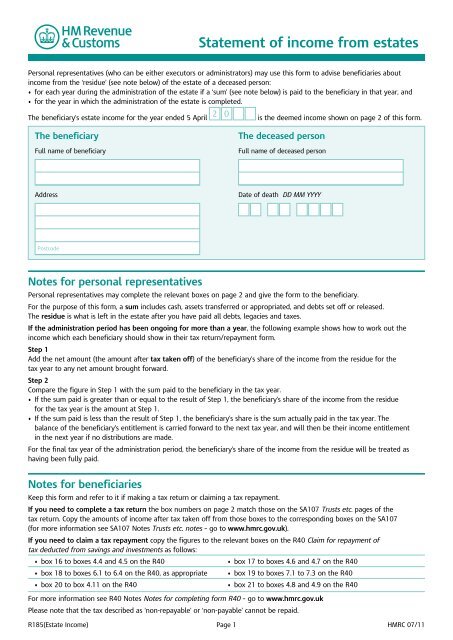

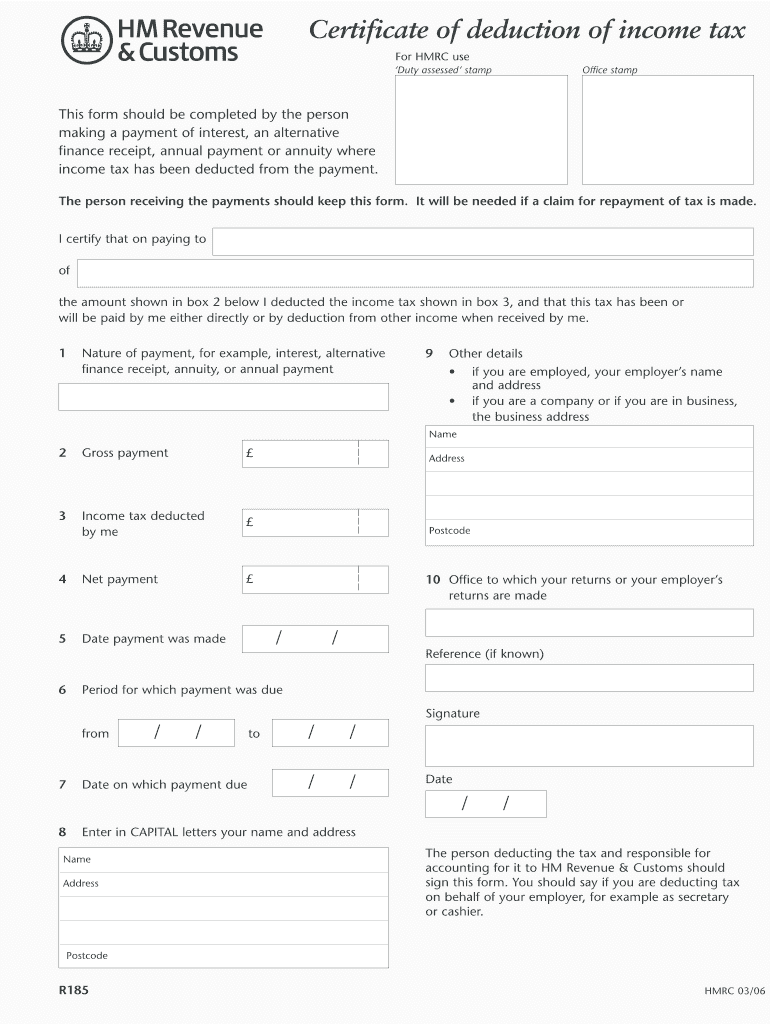

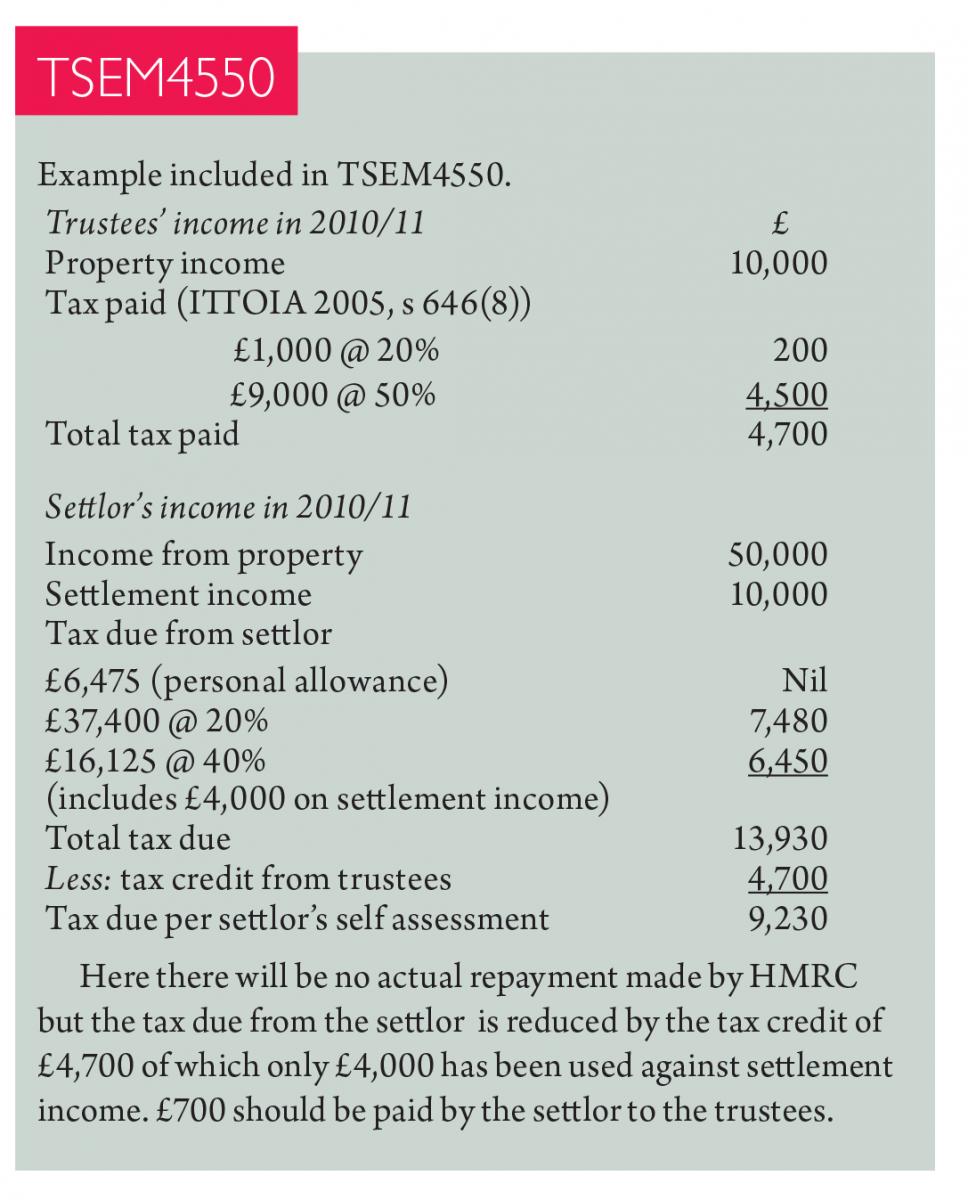

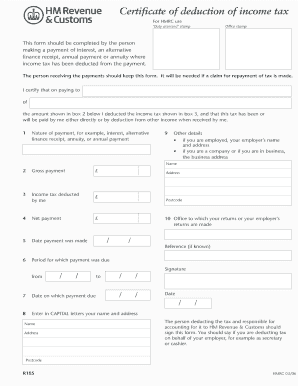

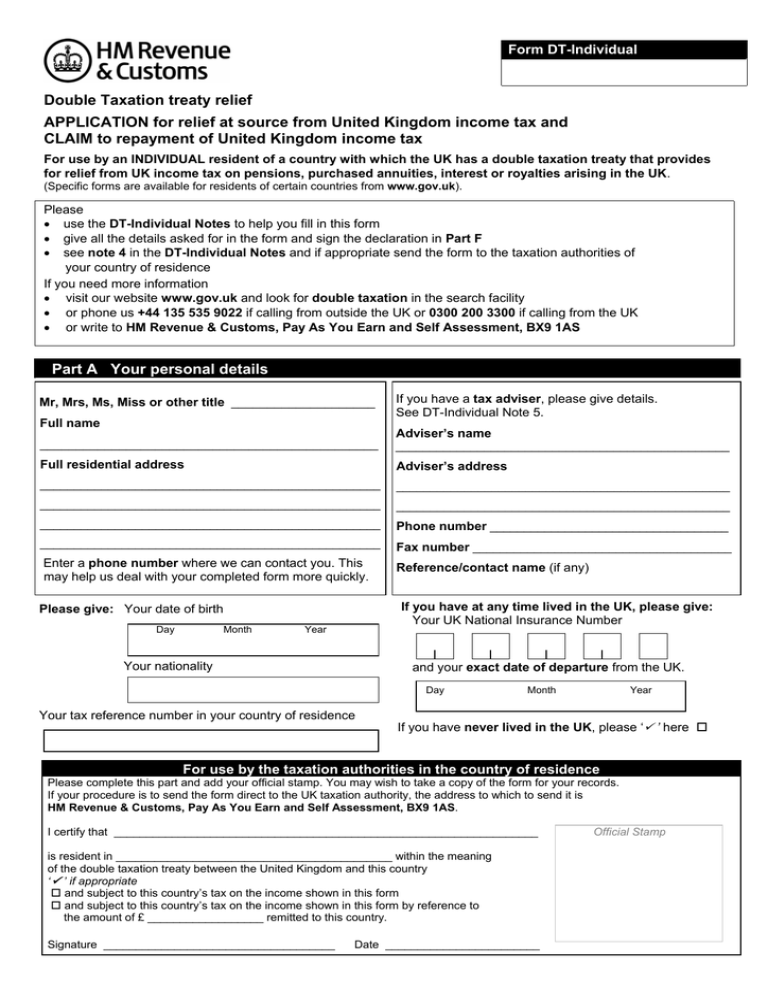

Example Of Completed R185 Form. If filed electronically this deadline is usually extended by two weeks. If bank interest is received during the administration of a deceaseds estate then I understand that the executor can write to HMRC on an informal basis for simple estates with the relevant details and request a payslip to pay the tax at 20 given interest from 6 April 2016 is now received gross. That this tax has been or will be paid by me either directly or by deduction from other income when received by me. 1 Nature of payment for example interest alternative finance receipt annuity or annual payment 9 Other details if you are employed your employers name and address if you are a company or if you are in business the business.

R185 Estate Income Statement Of Income From Estates From yumpu.com

R185 Estate Income Statement Of Income From Estates From yumpu.com

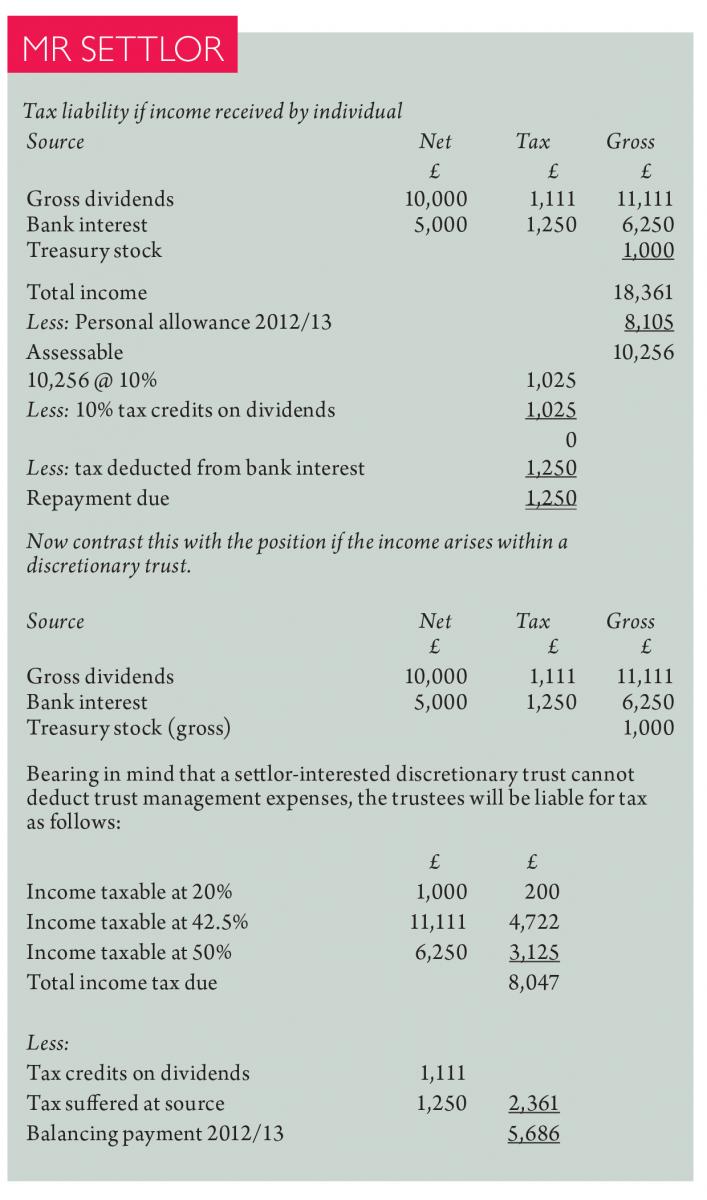

You must complete a Form R185 if you withhold tax from a payment. However the PRs would simply note that income in the estate had been received for which they will account for the. Post-death Capital Gains Tax Capital gains tax is a tax on the rise in the capital value of assets. Completion of R185 Estate Income. Pages of the tax return. The total taxable income to report amounts to 16866 which is from tax year 20142015 until 20162017.

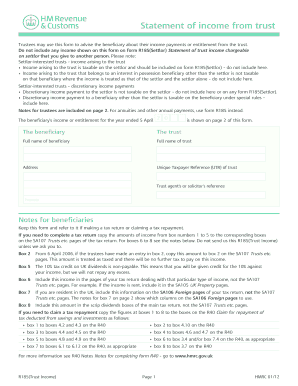

It is the beneficiarys responsibility to report any income and capital gains of an absolute trust.

1 Nature of payment for example interest alternative finance receipt annuity or annual payment 9 Other details if you are employed your employers name and address if you are a company or if you are in business the business. The total taxable income to report amounts to 16866 which is from tax year 20142015 until 20162017. R185 Certificate of deduction of income tax Subject. A beneficiary will receive income from a discretionary trust as trust income classed as non-savings income with a 45 tax credit shown on the form R185. It also shows tax deducted from that income before it is paid to the beneficiary. Completion of Form R185 Estate Income 20162017.

Source: axasun.blogspot.com

Source: axasun.blogspot.com

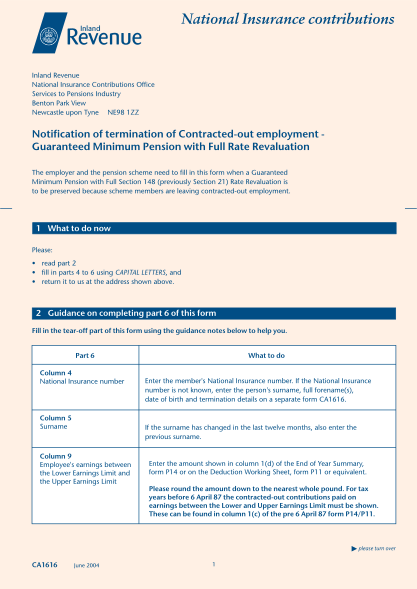

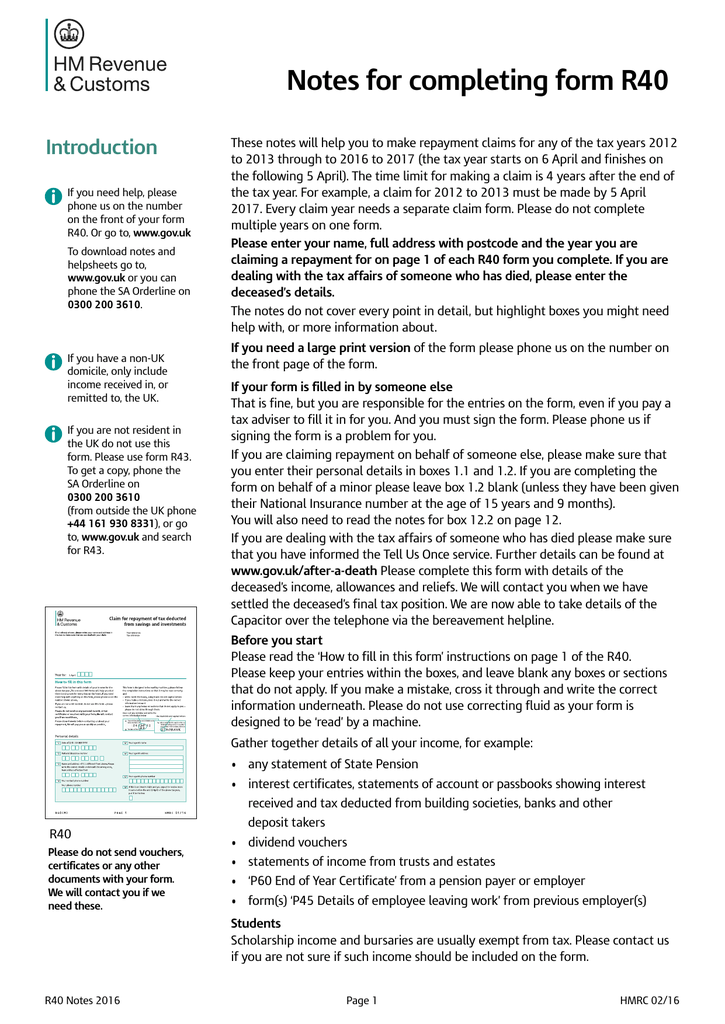

Chargeable Persons are required to submit a Form 11 to the Revenue Commissioners on or before the 31st October each year. The trust by registering the trust for tax on a Form TR1 apply to discretionary trust tax and the intended as a general guide to the taxation of trusts. In the example above the beneficiary receives gross trust income of 1000 and a tax credit for 450. R185 Certificate of deduction of income tax. The form also gives you instructions on how to complete a tax return including this income.

Source: uslegalforms.com

Source: uslegalforms.com

This means that in each of the charities R185s I will report that each charitys share of the income 16866. Do not send us this R185Trust Income unless we ask you to. This certificate should be completed by a person making a payment under deduction of tax. For the purpose of this form a sum includes cash assets transferred or appropriated and debts set off or released. R185 Certificate of deduction of income tax Subject.

Source: cocodoc.com

Source: cocodoc.com

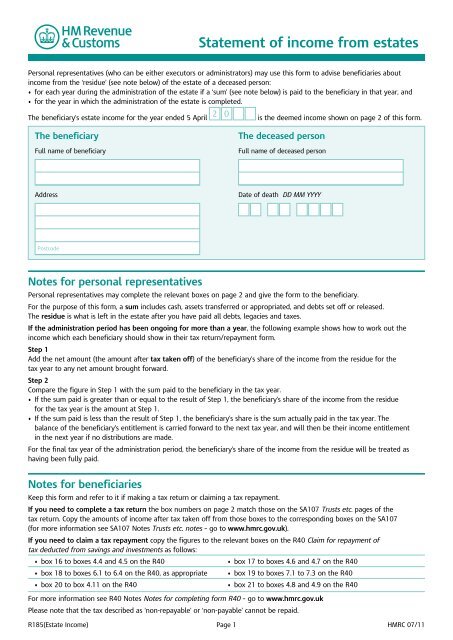

Post-death Capital Gains Tax Capital gains tax is a tax on the rise in the capital value of assets. R185Estate Income Page 1 HMRC 0317 Personal representatives who can be either executors or administrators may use this form to advise beneficiaries about. For example interest alternative finance receipt annuity or annual payment 2 Gross payment. Rent to a non-resident landlord. Keep this form and refer to it if making a tax return or claiming a tax repayment.

Source: studylib.net

Source: studylib.net

The total taxable income to report amounts to 16866 which is from tax year 20142015 until 20162017. This certificate should be completed by a person making a payment under deduction of tax. Completion of Form R185 Estate Income 20162017. An R185 form should be provided to the beneficiary when the income is paid out. When completed it should be.

Source: taxation.co.uk

Source: taxation.co.uk

When completed it should be. For boxes 6 to 8 see the notes below. Completion of Form R185 Estate Income 20162017. For the purpose of this form a sum includes cash assets transferred or appropriated and debts set off or released. 1 Nature of payment for example interest alternative finance receipt annuity or annual payment 9 Other details if you are employed your employers name and address if you are a company or if you are in business the business.

Source: form-r-185.pdffiller.com

Source: form-r-185.pdffiller.com

We complete Forms R185 Estate Income when finalising the tax position of an Estate. The residue is what is left in the estate after you have paid all debts legacies and taxes. So the trustees dont need to complete a tax return or form R185 Trust Income when passing income to the beneficiary. The personal representatives will provide the beneficiary with Form R185 Estate Income showing the amount of estate income paid to that beneficiary and the amount of tax suffered on that income. If the administration period has been ongoing for more than a year the following example shows how to.

Source: signnow.com

Source: signnow.com

We complete Forms R185 Estate Income when finalising the tax position of an Estate. The personal representatives will provide the beneficiary with Form R185 Estate Income showing the amount of estate income paid to that beneficiary and the amount of tax suffered on that income. A simple worked example shows the relevant mechanics of dealing with the tax liability on dividend income for 201617 see example 1. That this tax has been or will be paid by me either directly or by deduction from other income when received by me. Rent to a non-resident landlord.

Source: docplayer.net

Source: docplayer.net

You may have to withhold tax at the standard rate of 20 from certain payments. In the case of a third-party-owned system or leased system for example the third party or lessor is the System Owner. For example for the 2014 income tax. This form should be completed by the person making a payment of interest an alternative. This form should be completed by the person making a payment of interest an alternative.

Source: yumpu.com

Source: yumpu.com

R185 Certificate of deduction of income tax. In the case of a third-party-owned system or leased system for example the third party or lessor is the System Owner. Do not send us this R185Trust Income unless we ask you to. R185 Estate Income - statement of income from estate If you are an executor or administrator of an estate use this form to advise beneficiaries about income from the estate of a. Briefly Form R185 is given by trustees to a beneficiary detailing the income paid to the beneficiary during the tax year.

Source: docplayer.net

Source: docplayer.net

Rent to a non-resident landlord. You must complete a Form R185 if you withhold tax from a payment. R185Estate Income Page 1 HMRC 0317 Personal representatives who can be either executors or administrators may use this form to advise beneficiaries about. Chargeable Persons are required to submit a Form 11 to the Revenue Commissioners on or before the 31st October each year. The form also gives you instructions on how to complete a tax return including this income.

This is very straightforward if it is a payment from a discretionary trust the type of trust will be shown on the form R185. In the case of a third-party-owned system or leased system for example the third party or lessor is the System Owner. A A Reservation Request Form must have signatures of the Applicant Host Customer and System Owner if different from the Host Customer. Keep this form and refer to it if making a tax return or claiming a tax repayment. They can reclaim all or part of this depending on their own tax position.

Source: docplayer.net

Source: docplayer.net

RPC012397_EN_WB_L_1 NOTES 4 year time limit A claim for tax relief must be made within 4 years after the end of the tax year to which the claim relates. Personal representatives may complete the relevant boxes on page 2 and give the form to the beneficiary. This form should be completed by the person making a payment of interest an alternative. Annual payments known as annuities - for example royalty payments. If you need to complete a tax return copy the amounts of income from box numbers 1 to 5 to the corresponding boxes on the SA107 Trusts etc.

Source: yumpu.com

Source: yumpu.com

That this tax has been or will be paid by me either directly or by deduction from other income when received by me. This form should be completed by the person making a payment of interest an alternative. With effect from 6 April 2016 all interest is paid gross and dividends no longer have a Tax Credit attached to them. However the PRs would simply note that income in the estate had been received for which they will account for the. 1 Nature of payment for example interest alternative finance receipt annuity or annual payment 9 Other details if you are employed your employers name and address if you are a company or if you are in business the business.

This is very straightforward if it is a payment from a discretionary trust the type of trust will be shown on the form R185. In the case of a third-party-owned system or leased system for example the third party or lessor is the System Owner. Briefly Form R185 is given by trustees to a beneficiary detailing the income paid to the beneficiary during the tax year. You may have to withhold tax at the standard rate of 20 from certain payments. That this tax has been or will be paid by me either directly or by deduction from other income when received by me.

Source: studylib.net

Source: studylib.net

Keep this form and refer to it if making a tax return or claiming a tax repayment. This form should be completed by the person making a payment of interest an alternative. R185 Certificate of deduction of income tax. Example If a child takes an inheritance of 500000 from his parents and there was a prior group a benefit of. 1 Nature of payment for example interest alternative finance receipt annuity or annual payment 9 Other details if you are employed your employers name and address if you are a company or if you are in business the business.

Source: taxation.co.uk

Source: taxation.co.uk

It is the beneficiarys responsibility to report any income and capital gains of an absolute trust. You may have to withhold tax at the standard rate of 20 from certain payments. That this tax has been or will be paid by me either directly or by deduction from other income when received by me. Pages of the tax return. For example interest alternative finance receipt annuity or annual payment 2 Gross payment.

Source: yumpu.com

Source: yumpu.com

Do not send us this R185Trust Income unless we ask you to. The actual extended deadline each year is provided by Revenue Commissioners well in advance of the deadline. So the trustees dont need to complete a tax return or form R185 Trust Income when passing income to the beneficiary. Completion of R185 Estate Income. Do not send us this R185Trust Income unless we ask you to.

Source: form-r-185.pdffiller.com

Source: form-r-185.pdffiller.com

Annual payments known as annuities - for example royalty payments. The R185Estate Income statement has been updated for the 2019 to 2020 tax year as customers will no longer need to complete box 20 on this form. The beneficiary of the trust must be provided with a form R185 trust income showing the trust income broken down between the relevant income sources and the tax which is deemed to be deducted. R185 Certificate of deduction of income tax. The actual extended deadline each year is provided by Revenue Commissioners well in advance of the deadline.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title example of completed r185 form by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.