Your Example of form 8824 filled out images are ready. Example of form 8824 filled out are a topic that is being searched for and liked by netizens now. You can Download the Example of form 8824 filled out files here. Find and Download all royalty-free photos and vectors.

If you’re searching for example of form 8824 filled out images information linked to the example of form 8824 filled out interest, you have pay a visit to the right site. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Example Of Form 8824 Filled Out. Less Pay Off Made by Seller 14650 3. If you use your home office or garage as your main place of business you can claim some of the money you spend on rent utilities and other home expenses in one of two ways. Need help filling out IRS Form 8824 part3 lines 15-25. Difference of Line 3 and 4 1150 6.

How To Fill Out Form 8824 5 Steps With Pictures Wikihow From wikihow.com

How To Fill Out Form 8824 5 Steps With Pictures Wikihow From wikihow.com

We hope you can find what you need here. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template. Access IRS Tax Forms. Exchange property on Form 8949 when reporting an exchange on Form 8824. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out. Go to the IncomeDeductions Rent and Royalty worksheet.

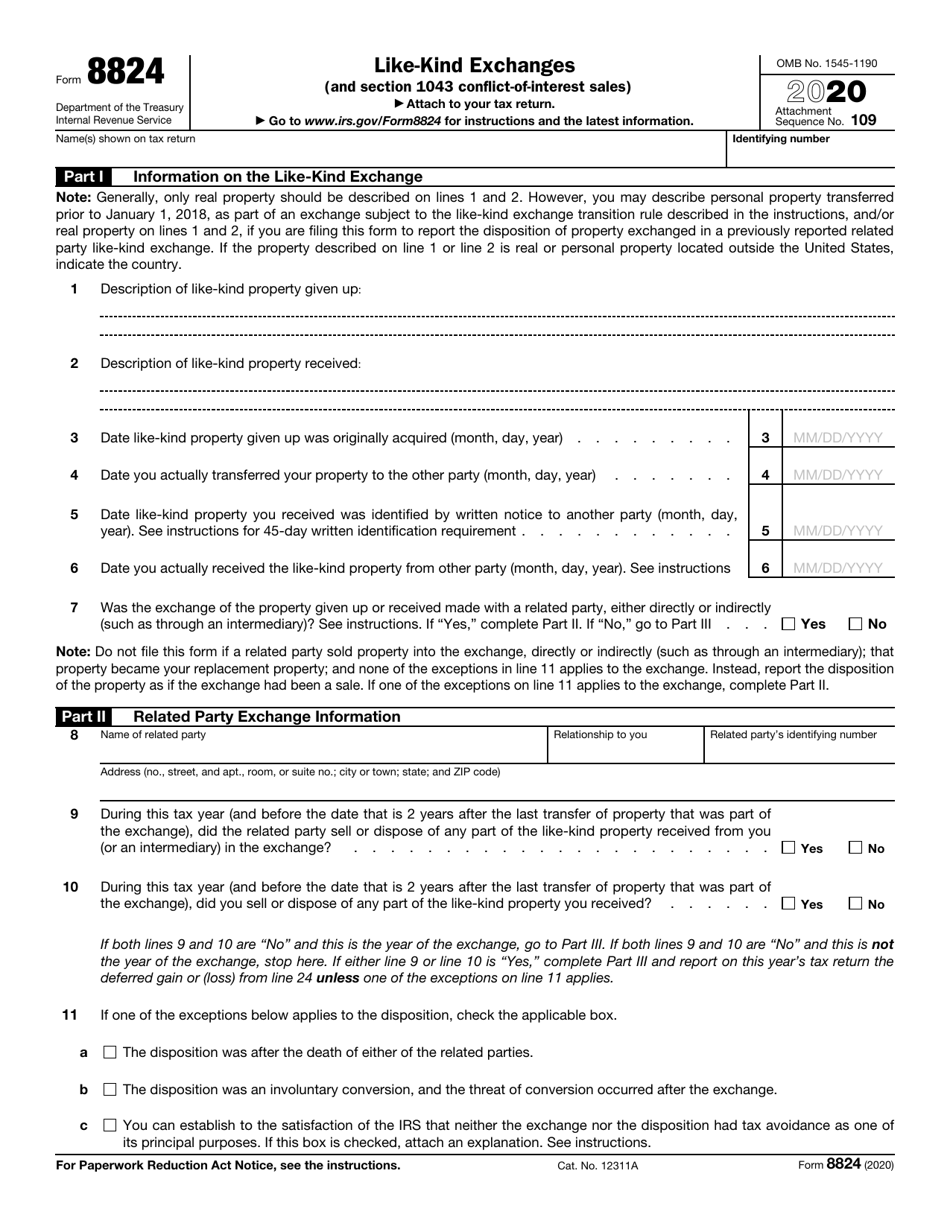

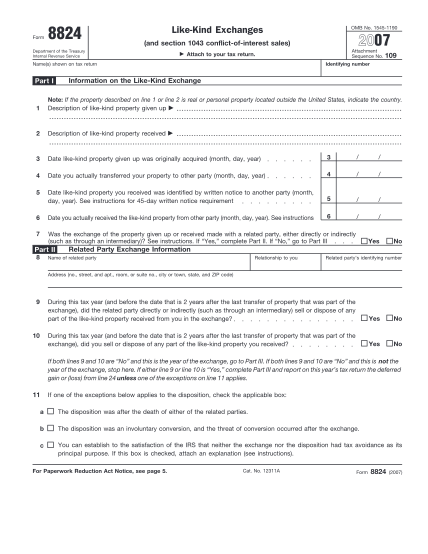

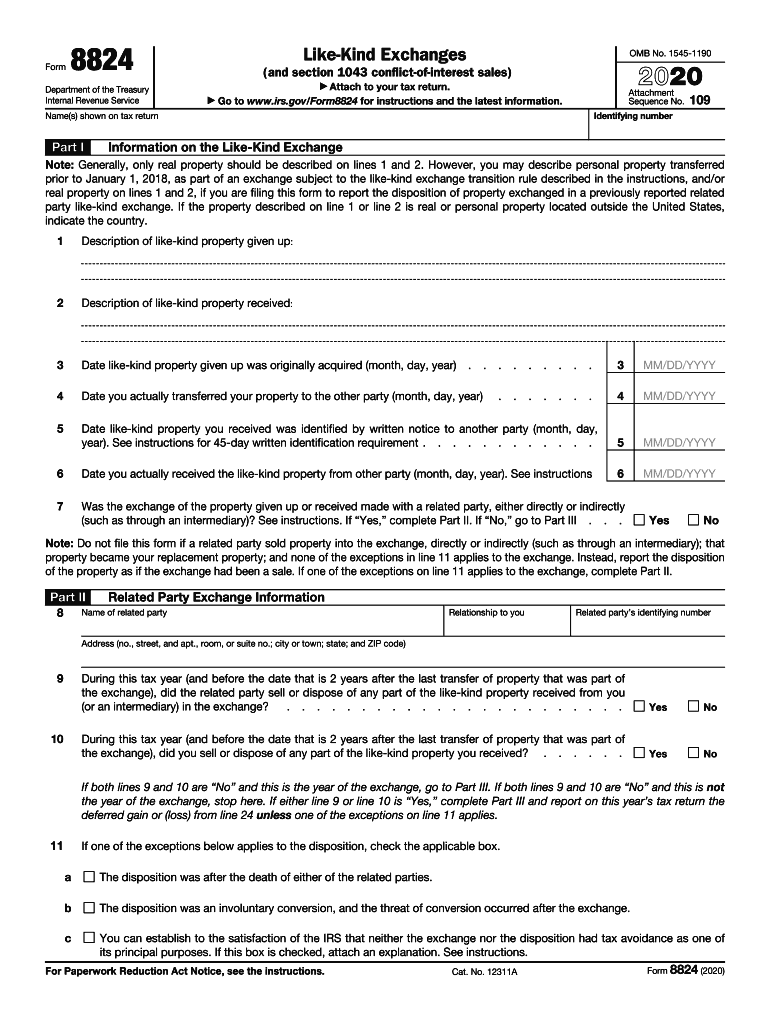

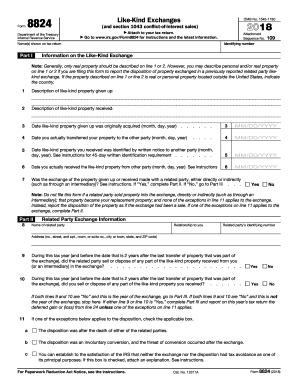

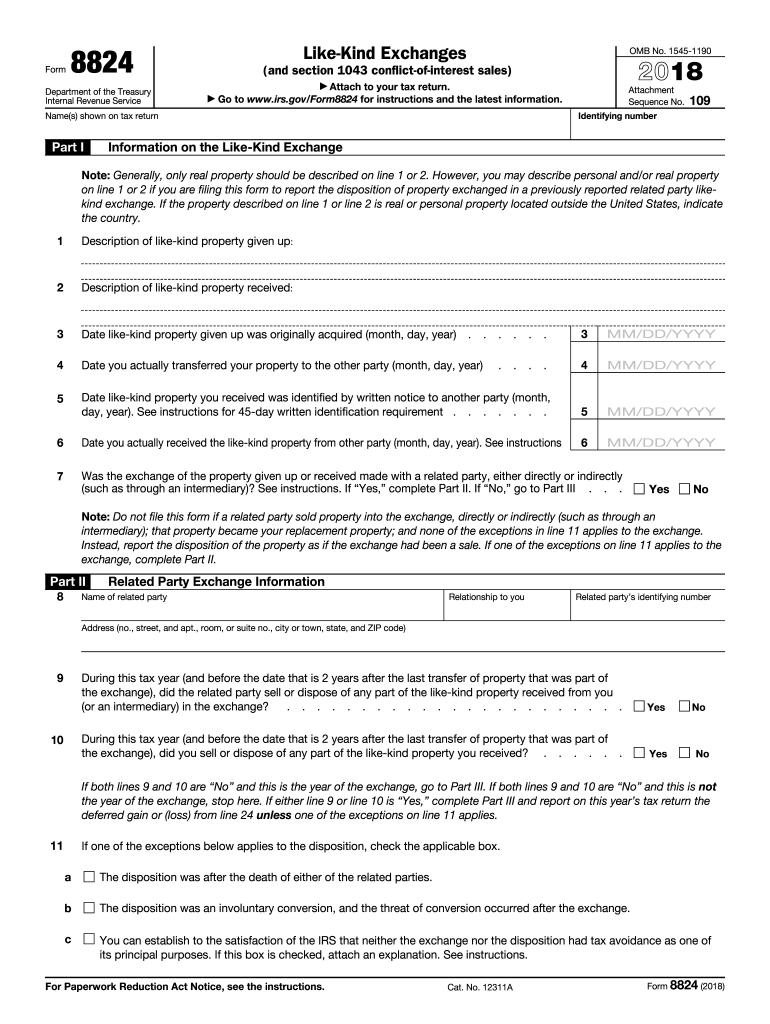

Form 8824 figures the amount of gain deferred as a result of a like-kind exchange.

Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Execution of the form calculates the amount of gain deferred due to a like-kind exchange of property. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Also the basis of the like-kind property received is figured on Form 8824. Generally the IRS prefers the use of only one 8824 form and the attachment of a statement indicating how you determined the gain if more than one exchange is entered into during one. We hope you can find what you need here.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. On the worksheet Form 8824 for the part of the property used as a home follow steps 1 through 3 above except that instead of following step 2 enter the amount from line 19 on line 20. Part I of Form 8824 is where you provide details about the old property and the new property Part II of the form comes into play only when a like-kind exchange involves related partiesmembers of a family or entities that you have a controlling interest in. Equals Net Trade In 4650 4. _____ 1031 Corporation - LongmontBoulder CO.

Source: wikihow.com

Source: wikihow.com

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Try out PDF blanks fill them out with required data and put your signature Filled In Form 8824. New Vehicle being purchased 34900 7. Exchange property on Form 8949 when reporting an exchange on Form 8824. Then prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3.

Source: templateroller.com

Source: templateroller.com

Exchange property on Form 8949 when reporting an exchange on Form 8824. Include your name and tax ID number at the top of each page of the statement. Part III computes the amount of gain required to be reported on the tax return in the current year if cash or property that isnt of a like kind is involved in the exchange. When completing the form its important to keep the following in mind. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out.

Get 2002 form 8824 fill in version like kind exchanges signed right from your smartphone using these six tips. Note the schedule and entity number of the like-kind exchange. Get 2002 form 8824 fill in version like kind exchanges signed right from your smartphone using these six tips. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out. The IRS considers the deal completed in the tax year that you sell the initial relinquished property and the exchange period begins.

Source: 155.138.174.80

Source: 155.138.174.80

How canshould I fill out Form 8824 with the following information provided. Equals Net Trade In 4650 4. We hope you can find what you need here. _____ 1031 Corporation - LongmontBoulder CO. Schedule E entity 1.

Source: wikihow.com

Source: wikihow.com

Sold 126 acres of unimproved timberland in a 1031 exchange for 190000. Access IRS Tax Forms. How to Fill out Form 8829. Completing Form 8824 WHEN TO FILE This form must be included with your tax return for the tax year in which a relinquished property was trans-ferred given up. Generally the IRS prefers the use of only one 8824 form and the attachment of a statement indicating how you determined the gain if more than one exchange is entered into during one.

Source: cocodoc.com

Source: cocodoc.com

The IRS considers the deal completed in the tax year that you sell the initial relinquished property and the exchange period begins. Original cost was117000 plus 3054 in settlement charges. On the worksheet Form 8824 for the part of the property used as a home follow steps 1 through 3 above except that instead of following step 2 enter the amount from line 19 on line 20. Try out PDF blanks fill them out with required data and put your signature Filled In Form 8824. IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet.

Source: pdffiller.com

Source: pdffiller.com

When completing the form its important to keep the following in mind. Completing Form 8824 WHEN TO FILE This form must be included with your tax return for the tax year in which a relinquished property was trans-ferred given up. Schedule E entity 1. Difference of Line 3 and 4 1150 6. We tried to get some great references about 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out for you.

Total to Form 8824 Line 18 12 Basis Of Replacement Property Before preparing Worksheet 1 read the attached Instructions for Preparation Of Form 8824 Worksheets. Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Property on Form 8949 when reporting an exchange on Form 8824. To produce a Form 8824 Like-Kind Exchanges and section 1043 conflict-of-interest sales in the system using the automatic sale feature the following steps are necessary. Download Or Email IRS 8824 More Fillable Forms Register and Subscribe Now.

You can calculate the square footage of your home office multiply that figure by 5 per square foot up to 300 square feet and claim it on. Worksheet April 17 2018. Difference of Line 3 and 4 1150 6. It was coming from reputable online resource and that we like it. Form 8824 figures the amount of gain deferred as a result of a like-kind exchange.

Source: signnow.com

Source: signnow.com

Download Or Email IRS 8824 More Fillable Forms Register and Subscribe Now. Our user-friendly interface will save your time and effort. _____ 1031 Corporation - LongmontBoulder CO. Difference of Line 3 and 4 1150 6. New Vehicle being purchased 34900 7.

Source: wikihow.com

Source: wikihow.com

Gross Trade-In allowance Old Vehicle 10000 2. Schedule E entity 1. Exchange property on Form 8949 when reporting an exchange on Form 8824. 1031 Exchange Worksheet Excel And Example Of Form 8824 Filled Out. Gross Trade-In allowance Old Vehicle 10000 2.

Source: pdffiller.com

Source: pdffiller.com

Part III computes the amount of gain required to be reported on the tax return in the current year if cash or property that isnt of a like kind is involved in the exchange. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template. To produce a Form 8824 Like-Kind Exchanges and section 1043 conflict-of-interest sales in the system using the automatic sale feature the following steps are necessary. Then prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. Go to the IncomeDeductions Rent and Royalty worksheet.

Execution of the form calculates the amount of gain deferred due to a like-kind exchange of property. Include your name and tax ID number at the top of each page of the statement. Sold 126 acres of unimproved timberland in a 1031 exchange for 190000. Go to the IncomeDeductions Rent and Royalty worksheet. Exchange property on Form 8949 when reporting an exchange on Form 8824.

Source: 155.138.174.80

Source: 155.138.174.80

Generally the IRS prefers the use of only one 8824 form and the attachment of a statement indicating how you determined the gain if more than one exchange is entered into during one. How canshould I fill out Form 8824 with the following information provided. Edit and print forms in a few clicks. It can be found on the internet for free. The IRS considers the deal completed in the tax year that you sell the initial relinquished property and the exchange period begins.

Source: pdffiller.com

Source: pdffiller.com

Generally the IRS prefers the use of only one 8824 form and the attachment of a statement indicating how you determined the gain if more than one exchange is entered into during one. Our user-friendly interface will save your time and effort. Cash 3500 5. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template. Also the basis of the like-kind property received is figured on Form 8824.

Difference of Line 3 and 4 1150 6. IRS 1031 Exchange Worksheet And Section 1031 Exchange Calculation Worksheet. Therefore the signNow web application is a must-have for completing and signing example of form 8824 filled out on the go. In a matter of seconds receive an electronic document with a legally-binding eSignature. Note the schedule and entity number of the like-kind exchange.

Source: jdunman.com

Source: jdunman.com

To produce a Form 8824 Like-Kind Exchanges and section 1043 conflict-of-interest sales in the system using the automatic sale feature the following steps are necessary. Get 2002 form 8824 fill in version like kind exchanges signed right from your smartphone using these six tips. Fill out only lines 15 through 25 of each worksheet Form 8824. Therefore the signNow web application is a must-have for completing and signing example of form 8824 filled out on the go. Total to Form 8824 Line 18 12 Basis Of Replacement Property Before preparing Worksheet 1 read the attached Instructions for Preparation Of Form 8824 Worksheets.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title example of form 8824 filled out by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.