Your Examples of discretionary trusts images are available in this site. Examples of discretionary trusts are a topic that is being searched for and liked by netizens now. You can Find and Download the Examples of discretionary trusts files here. Find and Download all free images.

If you’re looking for examples of discretionary trusts pictures information linked to the examples of discretionary trusts topic, you have visit the right site. Our site always gives you hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Examples Of Discretionary Trusts. First the trustees usually have the power to. Sally Brown has agreed to be the initial trustee of the trust. There are lots of different types of trusts that you can create when making a will and a discretionary trust is just one example. Our Customer Support team are on hand 24 hours a day to help with queries.

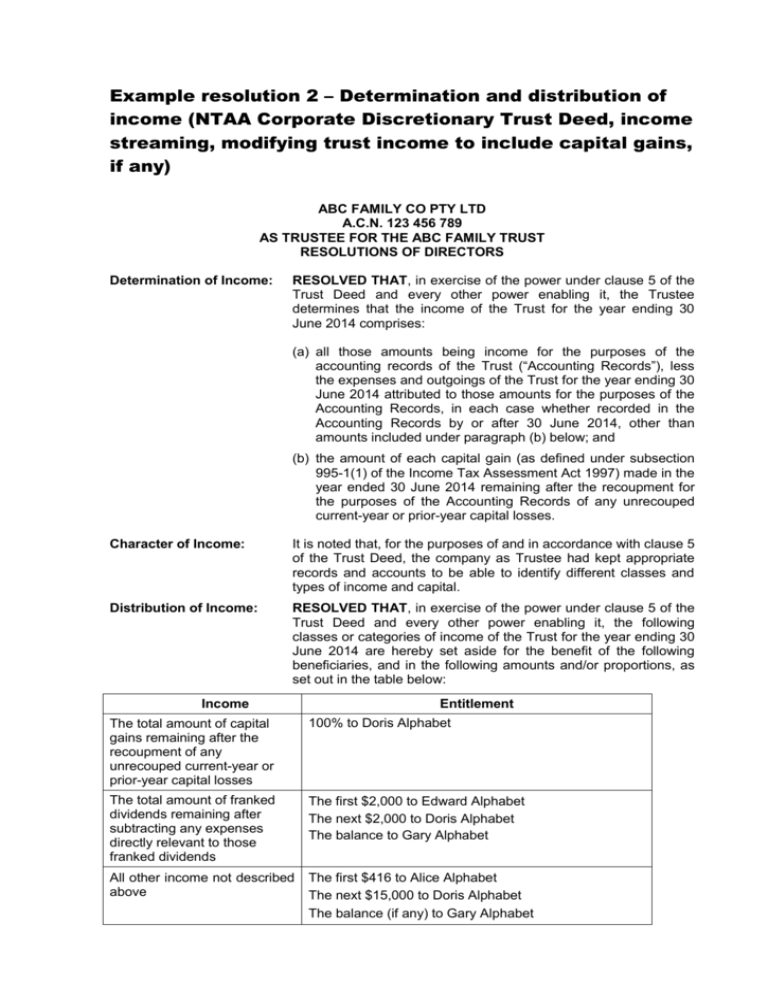

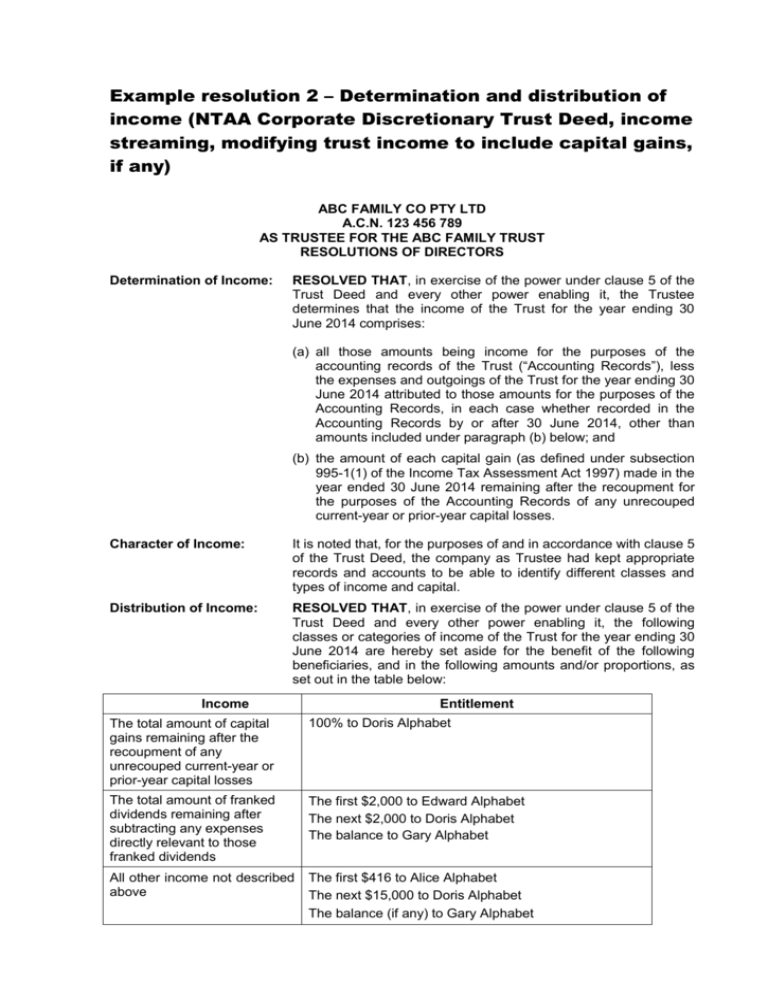

Example Resolution 2 Determination And Distribution Of Income From studylib.net

Example Resolution 2 Determination And Distribution Of Income From studylib.net

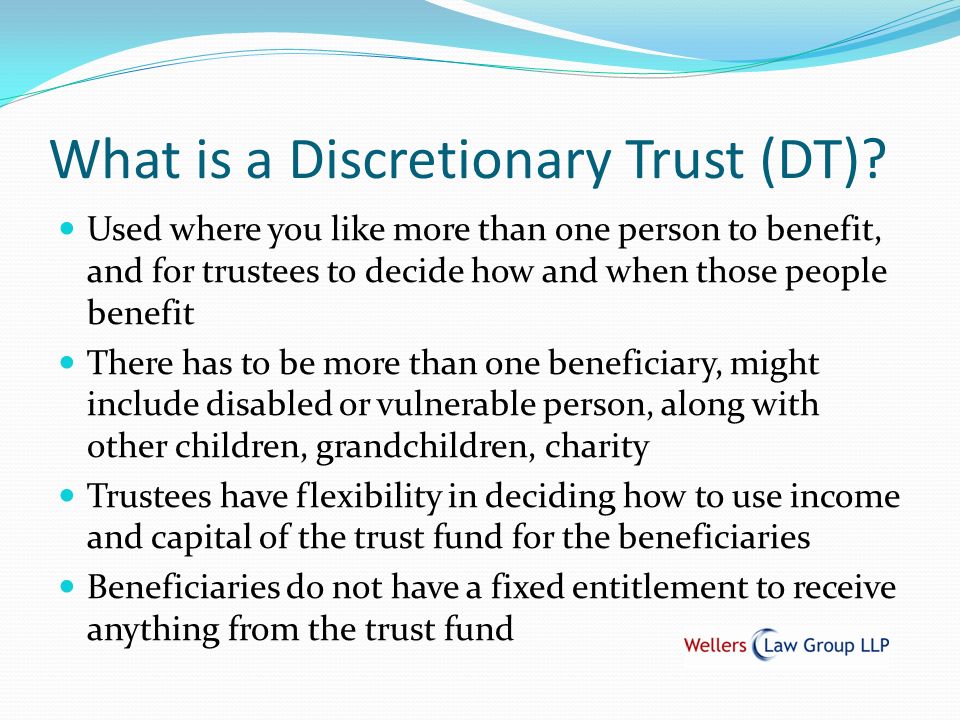

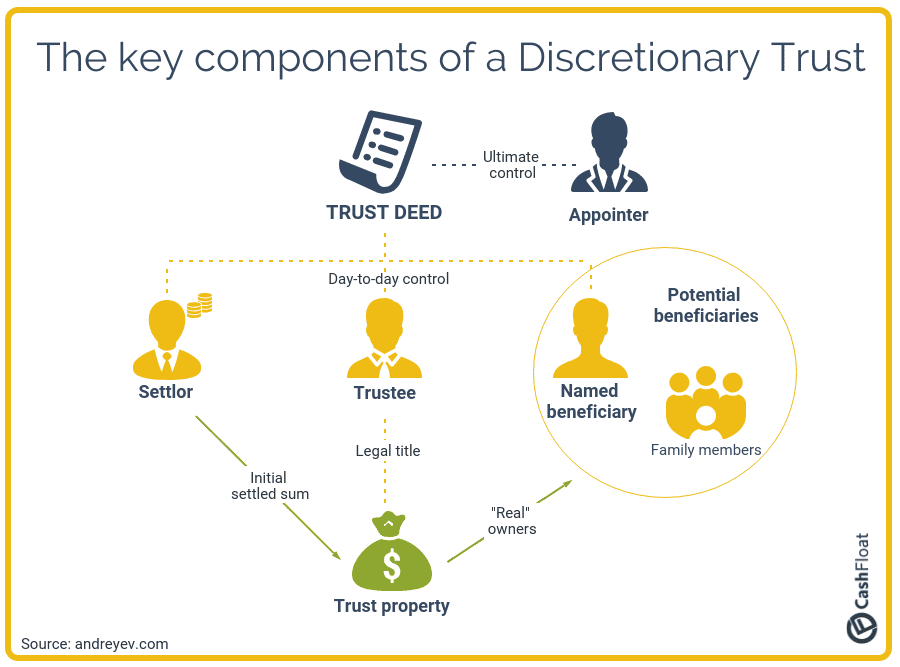

When you set up a Discretionary Trust you identify a class of beneficiaries such as children andor grandchildren who can receive capital andor income from the trust at the discretion. The trust may for example authorise a payment to any of. In a discretionary trust the trustee has the power to determine which beneficiaries receive the property or assets from the trust and how much. 44 345 600 9355. With a discretionary trust the trustees have absolute discretion over who may. A The trust Establishment of a discretionary trust 1 The settlor named in the Schedule Bob Brown has paid the Settled Sum specified in the Schedule to the trustee named in the Schedule Sally Brown to establish the Smith Family Trust.

If you want to set up a fami-ly trust and you also want to contribute property to the family trust then you.

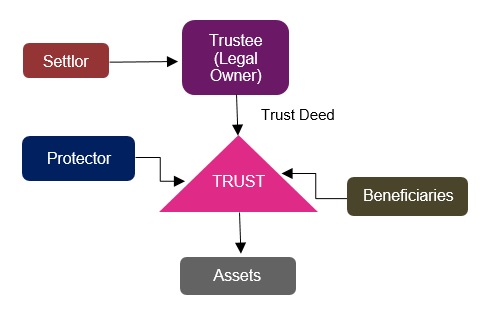

What happens with a discretionary trust in your will is that you leave your estate or part of it to a trust. A discretionary trust is a trust where the distribution of capital andor income of the trust to the beneficiaries of the trust is at the discretion of you the trustee. Ciary becomes a non-resident of Canada see discussion below. Ad Communicate Organize Your Wishes So No One Is Left Guessing Or Dealing With The Courts. This type of trust must be managed by the trustee specifically as designated by the creator of the trust also known as the settlor. A Discretionary Trust calls for legal and tax knowledge.

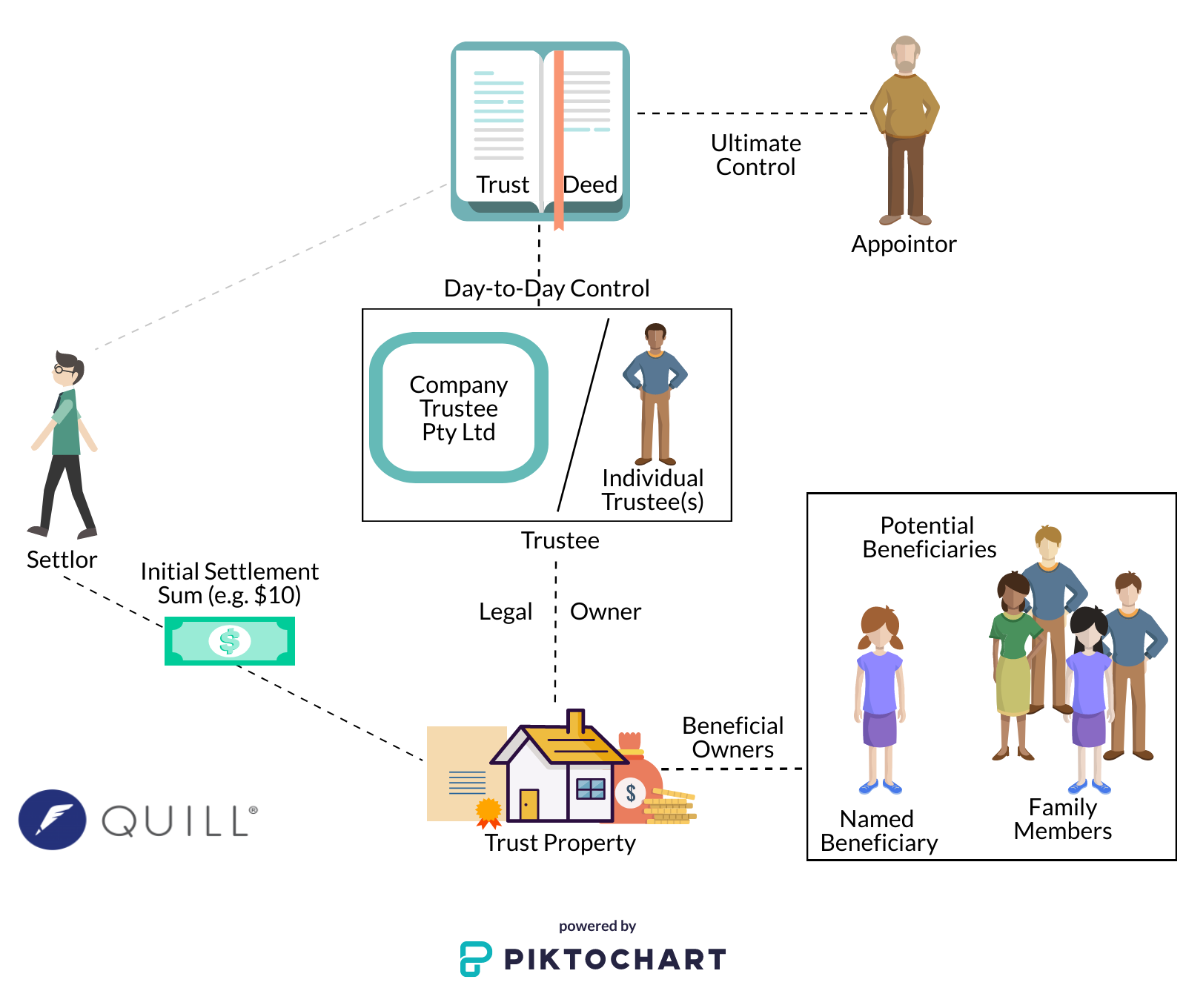

Source: quillgroup.com.au

Source: quillgroup.com.au

With a discretionary trust there are no named beneficiaries. These discretionary trusts offer the greatest divorce and asset protection because the decision to make or not to make a distribution is in the hands of your Trustee and not under the control of the beneficiary. Example is a pot trust that authorizes trust distributions for all of the grantors children typically until there is no child under a certain age say age 22 upon which event the trust. Using a Discretionary Trust for a life policy has lots of practical and nancial bene ts. Discretionary trusts can be discretionary in two respects.

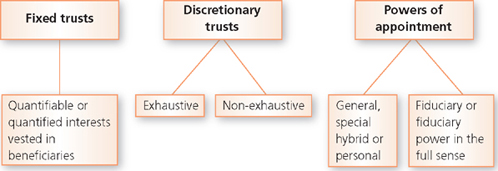

Source: lawexplores.com

Source: lawexplores.com

These discretionary trusts offer the greatest divorce and asset protection because the decision to make or not to make a distribution is in the hands of your Trustee and not under the control of the beneficiary. There are lots of different types of trusts that you can create when making a will and a discretionary trust is just one example. 5 Your Guide to Tax-Saving Strategies May 2018 TAXSTRATEGY Discretionary Family Trusts The Basics Samantha Prasad LLB. Trustees obligations under discretionary trusts are likely to be enforceable in courts at least in common law countries like the US and UK but this is a complicated and sophisticated legal arrangement which cannot easily be undone. A discretionary trust is a trust where the beneficiaries andor their entitlements to the trust fund are not fixed but are determined by the criteria set out in the trust instrument by trustor.

Source: pinterest.com

Source: pinterest.com

Client Guide to Discretionary Trusts What is a Discretionary Trust. For this reason trusts with spendthrift or addicted beneficiaries are usually drafted as discretionary trusts. A The trust Establishment of a discretionary trust 1 The settlor named in the Schedule Bob Brown has paid the Settled Sum specified in the Schedule to the trustee named in the Schedule Sally Brown to establish the Smith Family Trust. Discretionary Trust Deed Sample. A Discretionary Trust is a trust under which the trustees have the discretion to pay capital or income to any beneficiary or class of beneficiaries nominated by the settlor who will be the person setting up the trust.

Source: slideplayer.com

Source: slideplayer.com

In a discretionary trust the trustee has the power to determine which beneficiaries receive the property or assets from the trust and how much. Over 150K People Have Protected Their Family with a Living Trust. A Discretionary Trust calls for legal and tax knowledge. The trust may for example authorise a payment to any of. Using a Discretionary Trust for a life policy has lots of practical and nancial bene ts.

Source: lawpath.com.au

Source: lawpath.com.au

The advice may also refer to the income tax consequences of discretionary trusts in that trustees will benefit from the starting rate band of GBP1000 divided by the number of trusts set up by a settlor and dividends are taxed at 381 per cent and all other income is taxed at 45 per cent. 44 345 600 9355. The trustee is to act in accordance with this. Trustees obligations under discretionary trusts are likely to be enforceable in courts at least in common law countries like the US and UK but this is a complicated and sophisticated legal arrangement which cannot easily be undone. Examples of how IHT is applied to discretionary trusts can be found in our practical guide Trust IHT charges.

Source: legalvision.co.nz

Source: legalvision.co.nz

Sample training material Example Trust Deed. Description Distribution Trust Sample. A discretionary trust is a trust where the distribution of capital andor income of the trust to the beneficiaries of the trust is at the discretion of you the trustee. Call us on 0808 239 4634 or request a callback. A non-discretionary trust also known as a fixed interest trust is a trust in which the trustee having no decision-making powers in how the distributions are to be made to the beneficiaryies must follow the terms of distribution set out in the trust instrument.

Source: pinterest.com

Source: pinterest.com

Discretionary Trust Deed Sample. A Discretionary Trust is a legal arrangement which allows the owner of a life policy the settlor to give their policy to a trusted group of people the trustees who look after it. These discretionary trusts offer the greatest divorce and asset protection because the decision to make or not to make a distribution is in the hands of your Trustee and not under the control of the beneficiary. To access this resource sign in below or register for a free no-obligation trial Sign in. A deed creating a discretionary trust.

Source: pinterest.com

Source: pinterest.com

Instead there are predetermined lists of beneficiaries. OF USING A DISCRETIONARY TRUST. To access this resource sign in below or register for a free no-obligation trial Sign in. D the trustee of any other trust of which the Trustee as Trustee of this Trust is a beneficiary whether fixed discretionary or otherwise or holds an interest subject to there being no infringement of the Rule against Perpetuities. Our Customer Support team are on hand 24 hours a day to help with queries.

Source: lawexplores.com

Source: lawexplores.com

A Discretionary Trust calls for legal and tax knowledge. 44 345 600 9355. A discretionary trust is a trust where the distribution of capital andor income of the trust to the beneficiaries of the trust is at the discretion of you the trustee. A discretionary trust is a type of irrevocable trust that is set up to protect the assets funded into the trust for the benefit of the trusts beneficiary. Our Customer Support team are on hand 24 hours a day to help with queries.

Source: pinterest.com

Source: pinterest.com

A deed creating a discretionary trust. In a discretionary trust the trustee has the power to determine which beneficiaries receive the property or assets from the trust and how much. Example - Discretionary trust. Call us on 0808 239 4634 or request a callback. A discretionary trust is a trust where the beneficiaries andor their entitlements to the trust fund are not fixed but are determined by the criteria set out in the trust instrument by trustor.

Source: cashfloat.co.uk

Source: cashfloat.co.uk

If you want to set up a fami-ly trust and you also want to contribute property to the family trust then you. Using a Discretionary Trust for a life policy has lots of practical and nancial bene ts. Client Guide to Discretionary Trusts What is a Discretionary Trust. E the trustee of any other trust of which any one or more of the persons referred to in the. The settlor and trustees will be reassured that some.

Source: batescosgrave.com.au

Source: batescosgrave.com.au

Joint settlors Where the trust is created by joint settlors each settlors portion of the fund is treated as a separate trust. Client Guide to Discretionary Trusts What is a Discretionary Trust. Joint settlors Where the trust is created by joint settlors each settlors portion of the fund is treated as a separate trust. Discretionary trusts can be discretionary in two respects. D the trustee of any other trust of which the Trustee as Trustee of this Trust is a beneficiary whether fixed discretionary or otherwise or holds an interest subject to there being no infringement of the Rule against Perpetuities.

Source: sklawyers.com.au

Source: sklawyers.com.au

D the trustee of any other trust of which the Trustee as Trustee of this Trust is a beneficiary whether fixed discretionary or otherwise or holds an interest subject to there being no infringement of the Rule against Perpetuities. E the trustee of any other trust of which any one or more of the persons referred to in the. These can be family members including spouses or civil partners friends registered charities and even companies. Inheritance Tax It should help to ensure that any money paid. A discretionary trust is a trust where the beneficiaries andor their entitlements to the trust fund are not fixed but are determined by the criteria set out in the trust instrument by trustor.

Source: pinterest.com

Source: pinterest.com

Discretionary trusts can be discretionary in two respects. The settlor and trustees will be reassured that some. To access this resource sign in below or register for a free no-obligation trial Sign in. First the trustees usually have the power to. Using a Discretionary Trust for a life policy has lots of practical and nancial bene ts.

Source: studylib.net

Source: studylib.net

A fixed trust is designed to provide money or assets to beneficiaries according to a schedule. Example is a pot trust that authorizes trust distributions for all of the grantors children typically until there is no child under a certain age say age 22 upon which event the trust. D the trustee of any other trust of which the Trustee as Trustee of this Trust is a beneficiary whether fixed discretionary or otherwise or holds an interest subject to there being no infringement of the Rule against Perpetuities. A Discretionary Trust calls for legal and tax knowledge. Examples of how IHT is applied to discretionary trusts can be found in our practical guide Trust IHT charges.

Source: kensington-trust.com

Source: kensington-trust.com

A discretionary trust is a trust where the distribution of capital andor income of the trust to the beneficiaries of the trust is at the discretion of you the trustee. A non-discretionary trust also known as a fixed interest trust is a trust in which the trustee having no decision-making powers in how the distributions are to be made to the beneficiaryies must follow the terms of distribution set out in the trust instrument. Using a Discretionary Trust for a life policy has lots of practical and nancial bene ts. 1425 1961his critical Despite. Description Distribution Trust Sample.

Source: pinterest.com

Source: pinterest.com

A discretionary trust is a trust where the beneficiaries andor their entitlements to the trust fund are not fixed but are determined by the criteria set out in the trust instrument by trustor. 5 Your Guide to Tax-Saving Strategies May 2018 TAXSTRATEGY Discretionary Family Trusts The Basics Samantha Prasad LLB. A non-discretionary trust also known as a fixed interest trust is a trust in which the trustee having no decision-making powers in how the distributions are to be made to the beneficiaryies must follow the terms of distribution set out in the trust instrument. Our specialist team of Wills and Trusts Solicitors will use their expertise to ensure you are fully advised of the implications and your wishes are carried out. A Discretionary Trust is an arrangement that gives trustees flexibility and control over how best to use the trust assets for the benefit of the beneficiaries.

Source: pinterest.com

Source: pinterest.com

A The trust Establishment of a discretionary trust 1 The settlor named in the Schedule Bob Brown has paid the Settled Sum specified in the Schedule to the trustee named in the Schedule Sally Brown to establish the Smith Family Trust. The trust may for example authorise a payment to any of. For this reason trusts with spendthrift or addicted beneficiaries are usually drafted as discretionary trusts. There are lots of different types of trusts that you can create when making a will and a discretionary trust is just one example. Sally Brown has agreed to be the initial trustee of the trust.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title examples of discretionary trusts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.