Your Frs 102 example accounts images are ready. Frs 102 example accounts are a topic that is being searched for and liked by netizens today. You can Find and Download the Frs 102 example accounts files here. Find and Download all free photos.

If you’re looking for frs 102 example accounts images information linked to the frs 102 example accounts topic, you have pay a visit to the ideal blog. Our website frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

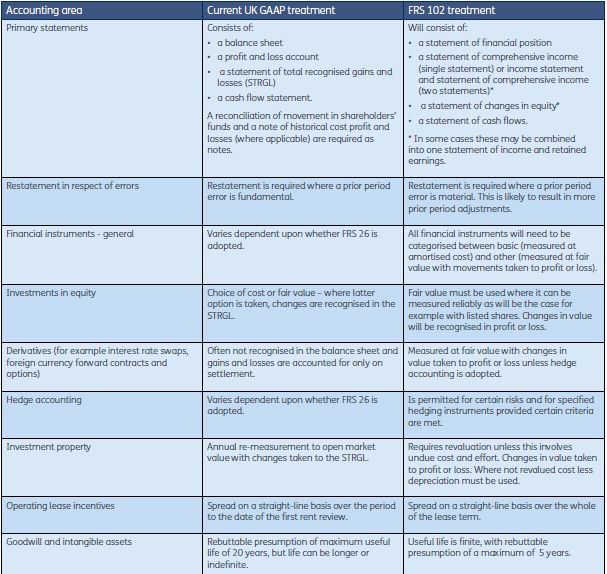

Frs 102 Example Accounts. KPMG Example Accounts Guide 2018 Introduction. The second edition of the SORP FRS 102 has been amended to include the changes set out in the second update bulletin. Accounting and Reporting by Charities. Companies House set of accounts Filleted accounts Companies House set of accounts not applying the Filleted accounts option Abridged Members set of accounts.

Frs 102 Correcting Errors Aat Comment From aatcomment.org.uk

Frs 102 Correcting Errors Aat Comment From aatcomment.org.uk

These are illustrative FRS 102 financial statements of a large private entity company and LLP prepared in accordance with FRS 102 including UK Companies Act disclosure requirements as applicable. 5 What is a small company. The 4 sets of proforma accounts included are. 8 FRSSE v Micro. 1 FRS 102 and FRS 105 Example small and micro company accounts Presented by John Selwood. Statement of Recommended Practice applicable to charities preparing their accounts in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland FRS 102 effective 1 January 2019 Secretariat to the Charities SORP CHARITIES SORP FRS 102 second edition - October 2019.

6 Small companies not micro 7 What is a micro company.

This publication contains an illustrative set of consolidated financial statements for Good Group International Limited the parent and its subsidiaries the Group for the year-end 31 December 2019 that is prepared in accordance with International Financial Reporting Standards IFRS. Following the significant amendments introduced by FRS 102 and the 2014 edition of the SORP the. Companies House set of accounts Filleted accounts Companies House set of accounts not applying the Filleted accounts option Abridged Members set of accounts. Preparing accounts under the new small and micro company regimes 4. The second edition of the SORP FRS 102 has been amended to include the changes set out in the second update bulletin. FRS 102 DART Deloitte Accounting Research Tool.

Source: docplayer.net

Source: docplayer.net

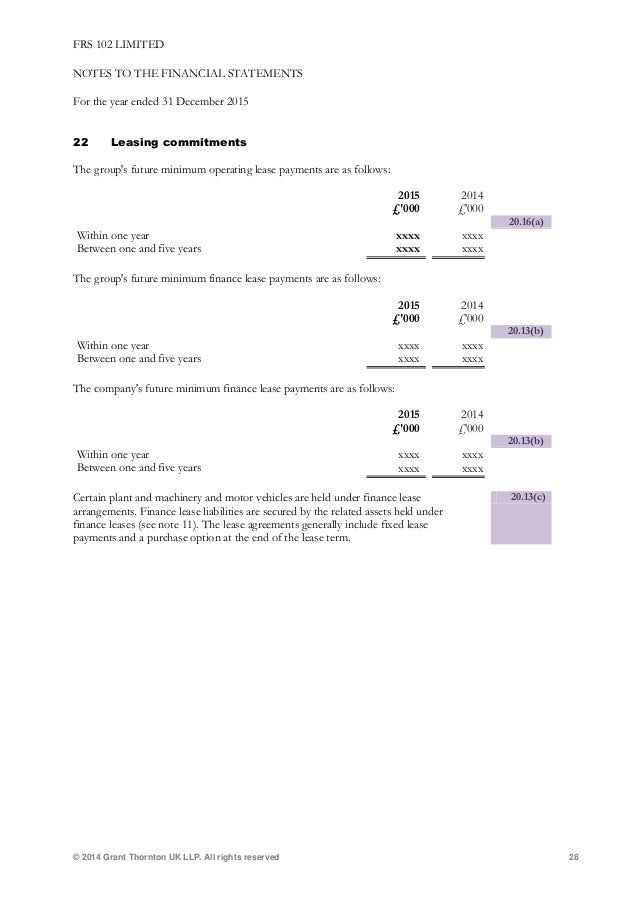

8 FRSSE v Micro. This publication provides illustrative financial statements for the year ended 31 December 2021. Illustrative financial statements Comments on the group and company statement of comprehensive income 36 Group Income statement continued FRS 10257 Under the two statement approach an entity shall present in an income statement the items to be included in a profit and loss account in accordance with Part 1 of LMCR. Sample UK Small Company FRS 102 Section 1A with examples for all sets of accounts options available. Example charity annual report and accounts 202021 Introduction In January 2016 the HFMA published an example NHS charity annual report and accounts to assist members with the preparation of their annual report and accounts in accordance with the SORP FRS 102.

Source: pbookshop.com

Source: pbookshop.com

This standard applies for all entities adopting International Accounting Standards for accounting periods commencing on or after 1 January 2005. Definitions The definition of prior period errors in FRS 102 and FRS 105 is mainly derived from IAS 8 to provide consistency between the standards. Members Set of Accounts Revenue Set of Accounts including the detailed profit and loss account. This publication contains an illustrative set of consolidated financial statements for Good Group International Limited the parent and its subsidiaries the Group for the year-end 31 December 2019 that is prepared in accordance with International Financial Reporting Standards IFRS. At 31 December 2015 the quoted price for live cattle delivered to the local slaughterhouse to which the entity delivers its livestock is 400 per 18-month-old animal.

Source: studylib.net

Source: studylib.net

Charities SORP FRS 102 update bulletin. These illustrative financial statements show the principal requirements of FRS 102 including the 2018 Pensions SORP and include disclosures relating to the early adoption of the 2018 SORP and. Abridged Companies House set of accounts Filleted accounts. We have updated our guide to take account of the recent changes to FRS 102 and the SORP. This standard applies for all entities adopting International Accounting Standards for accounting periods commencing on or after 1 January 2005.

Source: slideshare.net

Source: slideshare.net

Deloitte uses strictly necessary cookies and similar technologies to operate this website and to provide you with a more personalized user experience. The example is updated. In addition to strictly necessary cookies Deloitte uses optional cookies to enhance and personalize your experience conduct analytics such. Accounting for Agriculture under frs 102 Example Moneyrea Ltd raises cattle for the beef industry. This publication provides illustrative financial statements for the year ended 31 December 2021.

Source: docplayer.net

Source: docplayer.net

The original accounting formats are prepared under FRSSE 2008 and are for the year ended 31. Sample UK Small Company FRS 102 Section 1A with examples for all sets of accounts options available. 6 Small companies not micro 7 What is a micro company. The example is updated. Definitions The definition of prior period errors in FRS 102 and FRS 105 is mainly derived from IAS 8 to provide consistency between the standards.

Source: mondaq.com

Source: mondaq.com

At 31 December 2015 the entitys herds included 800 18-month-old cattle. Sample UK Small Company FRS 102 Section 1A with examples for all sets of accounts options available. Welcome to the 2018 edition of KPMGs guide to pension scheme financial statements. 8 FRSSE v Micro. Charities SORP FRS 102 update bulletin.

Source: aatcomment.org.uk

Source: aatcomment.org.uk

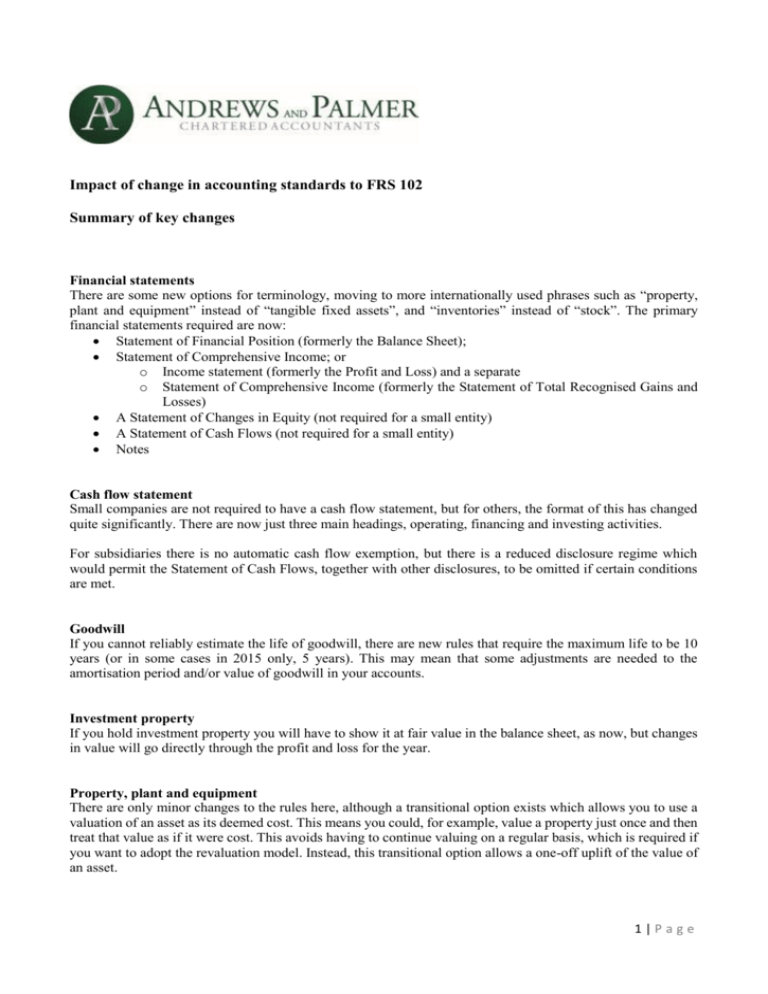

This guide outlines the accounting requirements under FRS 102 when loan contract terms are renegotiated together with illustrative examples. A modern experience with real-time updates predictive search functionality PwC curated content pages and user-friendly sharing features Viewpoint helps you find the insights and content you need when you need it. Following the significant amendments introduced by FRS 102 and the 2014 edition of the SORP the. These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for UK groups and UK companies reporting under FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland. There is also a summary to guide users to complete the correct disclosure checklist.

Source: help.iris.co.uk

Source: help.iris.co.uk

Companies House set of accounts Filleted accounts Companies House set of accounts not applying the Filleted accounts option Abridged Members set of accounts. This standard applies for all entities adopting International Accounting Standards for accounting periods commencing on or after 1 January 2005. Deloitte uses strictly necessary cookies and similar technologies to operate this website and to provide you with a more personalized user experience. FRS 105 financial statements. All the options above with the exception of EU-adopted IFRSs are Companies Act and UK GAAP accounts.

Source: aatcomment.org.uk

Source: aatcomment.org.uk

Example charity annual report and accounts 202021 Introduction In January 2016 the HFMA published an example NHS charity annual report and accounts to assist members with the preparation of their annual report and accounts in accordance with the SORP FRS 102. Deloitte uses strictly necessary cookies and similar technologies to operate this website and to provide you with a more personalized user experience. Statement of Recommended Practice applicable to charities preparing their accounts in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland FRS 102 effective 1 January 2019 Secretariat to the Charities SORP CHARITIES SORP FRS 102 second edition - October 2019. Preparing accounts under the new small and micro company regimes 4. There is also a summary to guide users to complete the correct disclosure checklist.

Source: help.iris.co.uk

Source: help.iris.co.uk

Preparing accounts under the new small and micro company regimes 4. Sample UK Small Company FRS 102 Section 1A with examples for all sets of accounts options available. A modern experience with real-time updates predictive search functionality PwC curated content pages and user-friendly sharing features Viewpoint helps you find the insights and content you need when you need it. 5 What is a small company. FRS 105 financial statements.

The second edition of the SORP FRS 102 has been amended to include the changes set out in the second update bulletin. Implications of COVID-19 for the preparation of accounts under FRS 102 Financial Reporting Faculty A checklist of some of the factors to consider when preparing your or your clients accounts. Deloitte uses strictly necessary cookies and similar technologies to operate this website and to provide you with a more personalized user experience. This publication provides illustrative financial statements for the year ended 31 December 2021. FRS 102 for small entities and FRS 105 using the following font like this.

Source: docplayer.net

Source: docplayer.net

The original accounting formats are prepared under FRSSE 2008 and are for the year ended 31. Statement of Recommended Practice applicable to charities preparing their accounts in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland FRS 102 effective 1 January 2019 Secretariat to the Charities SORP CHARITIES SORP FRS 102 second edition - October 2019. Members Set of Accounts Revenue Set of Accounts including the detailed profit and loss account. All the options above with the exception of EU-adopted IFRSs are Companies Act and UK GAAP accounts. Sample Republic of Ireland Small Company FRS 102 Section 1A sets of accounts with examples for all accounts options available.

Source: docplayer.net

Source: docplayer.net

A modern experience with real-time updates predictive search functionality PwC curated content pages and user-friendly sharing features Viewpoint helps you find the insights and content you need when you need it. 1 FRS 102 and FRS 105 Example small and micro company accounts Presented by John Selwood. Sample UK Small Company FRS 102 Section 1A with examples for all sets of accounts options available. Abridged Companies House set of accounts Filleted accounts. Transition to FRS 102 17 Transition to FRS 102.

Source: aatcomment.org.uk

Source: aatcomment.org.uk

Example charity annual report and accounts 202021 Introduction In January 2016 the HFMA published an example NHS charity annual report and accounts to assist members with the preparation of their annual report and accounts in accordance with the SORP FRS 102. We have updated our guide to take account of the recent changes to FRS 102 and the SORP. FRS 102 for small entities and FRS 105 using the following font like this. 8 FRSSE v Micro. The 4 sets of proforma accounts included are.

Source: docplayer.net

Source: docplayer.net

The example annual report that follows includes the financial statements of Typipens Pension Scheme a United Kingdom Occupational Pension Scheme. Members Set of Accounts Revenue Set of Accounts including the detailed profit and loss account. At 31 December 2015 the quoted price for live cattle delivered to the local slaughterhouse to which the entity delivers its livestock is 400 per 18-month-old animal. Accounting for Agriculture under frs 102 Example Moneyrea Ltd raises cattle for the beef industry. Worked example 30 Disclosure requirements 42 This factsheet has been produced in partnership with Steve Collings FMAAT FCCA director of Leavitt Walmsley Associates Ltd chartered certified accountants lecturer and author of financial reporting publications.

FRS 102 accounts for a small company opting to prepare full FRS 102 financial statements for example when approaching the small company thresholds or a group requirement. Illustrative financial statements Comments on the group and company statement of comprehensive income 36 Group Income statement continued FRS 10257 Under the two statement approach an entity shall present in an income statement the items to be included in a profit and loss account in accordance with Part 1 of LMCR. Charities SORP FRS 102 update bulletin. FRS 102 1A case study FRS 105 example accounts FRS 102 1A related party disclosures. These illustrative financial statements show the principal requirements of FRS 102 including the 2018 Pensions SORP and include disclosures relating to the early adoption of the 2018 SORP and.

Model FRS 102 accounts. KPMG Example Accounts Guide 2018 Introduction. Model FRS 102 accounts. The second edition of the SORP FRS 102 has been amended to include the changes set out in the second update bulletin. Definitions The definition of prior period errors in FRS 102 and FRS 105 is mainly derived from IAS 8 to provide consistency between the standards.

Source: taxation.co.uk

Source: taxation.co.uk

8 FRSSE v Micro. The example annual report that follows includes the financial statements of Typipens Pension Scheme a United Kingdom Occupational Pension Scheme. The 4 sets of proforma accounts included are. The example is updated. These changes are all the result of amendments to FRS 102 that are applicable for accounting periods starting on or after 1 January 2019.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title frs 102 example accounts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.