Your Phantom stock plan example images are ready in this website. Phantom stock plan example are a topic that is being searched for and liked by netizens today. You can Get the Phantom stock plan example files here. Download all royalty-free photos.

If you’re looking for phantom stock plan example pictures information connected with to the phantom stock plan example topic, you have visit the right site. Our site always provides you with hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

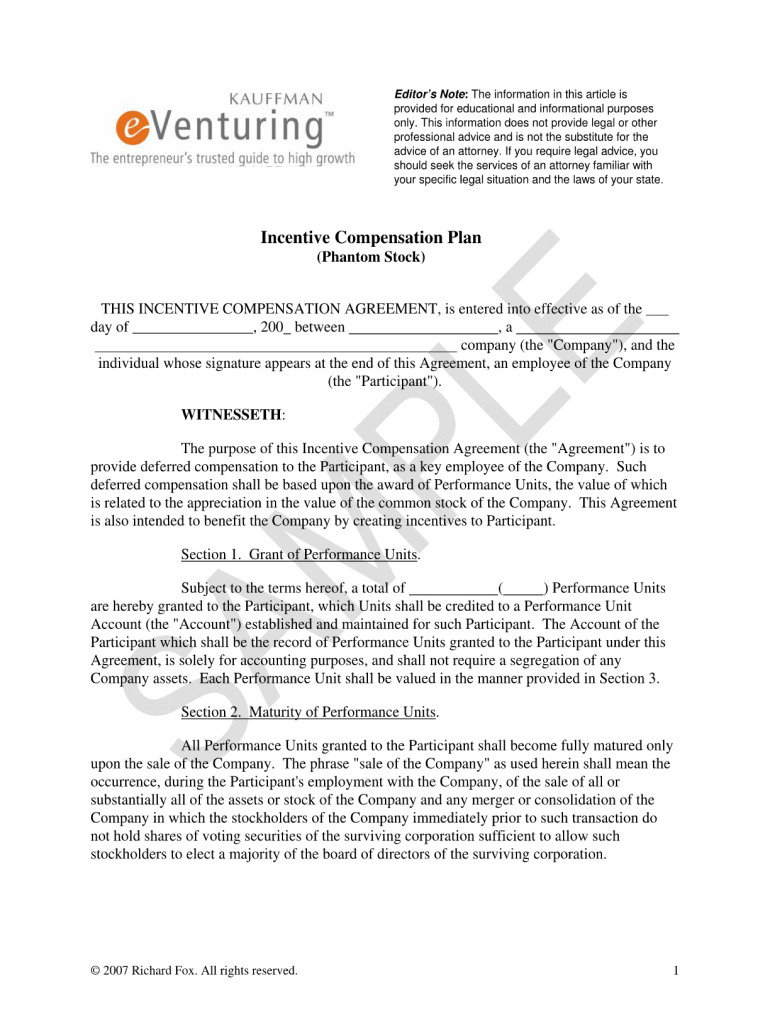

Phantom Stock Plan Example. As such where an exemption does not apply the payment. It depends on how the phantom stock plan is set up but they definitely can include divident payments to phantom shareholders which is a great benefit to owners of said. The phantom stock plan must specify when the phantom stock payments should commence at which point a valuation of the units is generally triggered as described above. Phantom Stock Option Plan.

Conclusion And Recommendation Thesis Sample Wars Of The Roses Thesis Plurals From pinterest.com

Conclusion And Recommendation Thesis Sample Wars Of The Roses Thesis Plurals From pinterest.com

A phantom stock plan is employee compensation that gives selected employees mostly in senior management benefits of stock ownership without actually giving. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. Phantom stock plans also known as equity compensation plans equity pay plans stock bonus plans or phantom equity plans are a form of employee stock option plan ESOP. This article will review and discuss the valuation issues common in designing a. There are two main types of. For example suppose an employee received 10 phantom shares with a starting value of 7 and assume the shares are valued on the payment date at 15.

A Phantom Stock Option Plan also known as a Stock Appreciation Rights SAR plan is a deferred cash bonus program that creates a similar result as a stock.

One of the key considerations is the valuation of the business. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. The other document needed is a. The phantom stock plan must specify when the phantom stock payments should commence at which point a valuation of the units is generally triggered as described above. For example suppose an employee received 10 phantom shares with a starting value of 7 and assume the shares are valued on the payment date at 15. Phantom stock is considered deferred compensation and is therefore subject to Section 409A unless an exemption applies.

Source: pinterest.com

Source: pinterest.com

11 Effective DATE the Award Date the Corporation awards to EMPLOYEE the Participant XXX shares of phantom stock the Phantom Stock valued by dividing by the closing price. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. However with phantom stock your tax deduction ie the companys is higher than it would have been with actual stock. For example if employee A were to receive 1000 shares of phantom stock with each stock worth 20 the current value of the company stock would be 20000. A phantom stock plan is a form of deferred compensation and will need to be carefully structured to avoid any adverse tax consequences to the key employee under Section 409A.

Source: pinterest.com

Source: pinterest.com

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. In an appreciation only phantom stock plan the plan participant receives a cash. There are two main types of.

Source: pinterest.com

Source: pinterest.com

Phantom stock is considered deferred compensation and is therefore subject to Section 409A unless an exemption applies. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Appreciation Only Phantom Stock Plans. In an appreciation only phantom stock plan the plan participant receives a cash. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

Source: slideshare.net

Source: slideshare.net

For a select group of management personnel is intended to advance the best. A phantom stock plan is employee compensation that gives selected employees mostly in senior management benefits of stock ownership without actually giving. The phantom stock plan must specify when the phantom stock payments should commence at which point a valuation of the units is generally triggered as described above. For a select group of management personnel is intended to advance the best. Phantom Stock Plans give select employees and senior management the benefit of stock ownership though without actual company stock.

Source:

Source:

Designing phantom stock plans can be tricky. As such where an exemption does not apply the payment. A Phantom Stock Plan is customized to fit each advisors fact pattern and goals. A phantom stock plan is a form of deferred compensation and will need to be carefully structured to avoid any adverse tax consequences to the key employee under Section 409A. However with phantom stock your tax deduction ie the companys is higher than it would have been with actual stock.

Source: pinterest.com

Source: pinterest.com

This Phantom Stock Plan the Plan of Texas Oil Chemical Co. A Phantom Stock Option Plan also known as a Stock Appreciation Rights SAR plan is a deferred cash bonus program that creates a similar result as a stock. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. 11 Effective DATE the Award Date the Corporation awards to EMPLOYEE the Participant XXX shares of phantom stock the Phantom Stock valued by dividing by the closing price. However with phantom stock your tax deduction ie the companys is higher than it would have been with actual stock.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

It depends on how the phantom stock plan is set up but they definitely can include divident payments to phantom shareholders which is a great benefit to owners of said. Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Phantom Stock Plans give select employees and senior management the benefit of stock ownership though without actual company stock. The two main types of phantom stock plans are. The Phantom Stock Plan.

Source: pinterest.com

Source: pinterest.com

PHANTOM STOCK PLAN 1. There are two main types of. One of the key considerations is the valuation of the business. For example suppose an employee received 10 phantom shares with a starting value of 7 and assume the shares are valued on the payment date at 15. In an appreciation only phantom stock plan the plan participant receives a cash.

Source:

Source:

Phantom stock is considered deferred compensation and is therefore subject to Section 409A unless an exemption applies. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. Phantom stock plans also known as equity compensation plans equity pay plans stock bonus plans or phantom equity plans are a form of employee stock option plan ESOP. However with phantom stock your tax deduction ie the companys is higher than it would have been with actual stock. The two main types of phantom stock plans are.

Source: signnow.com

Source: signnow.com

A Phantom Stock Plan is customized to fit each advisors fact pattern and goals. This Phantom Stock Plan the Plan of Texas Oil Chemical Co. PHANTOM STOCK PLAN 1. A phantom stock plan is a form of deferred compensation and will need to be carefully structured to avoid any adverse tax consequences to the key employee under Section 409A. It depends on how the phantom stock plan is set up but they definitely can include divident payments to phantom shareholders which is a great benefit to owners of said.

Source: pinterest.com

Source: pinterest.com

This article will review and discuss the valuation issues common in designing a. The two main types of phantom stock plans are. The other document needed is a. There are two main types of. The Phantom Stock Plan.

Source: pinterest.com

Source: pinterest.com

PHANTOM STOCK PLAN 1. However with phantom stock your tax deduction ie the companys is higher than it would have been with actual stock. A Phantom Stock Plan is customized to fit each advisors fact pattern and goals. Phantom Stock Option Plan. A Phantom Stock Option Plan also known as a Stock Appreciation Rights SAR plan is a deferred cash bonus program that creates a similar result as a stock.

This article will review and discuss the valuation issues common in designing a. This Phantom Stock Agreement evidences the grant to you on the Grant Date set forth on the cover page of Phantom Stock the Phantom Stock under the 2009 Restatement of the WMS. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. In the first case actual stock your deduction was for 50000 thus a. A phantom stock plan pays a cash award to an employee that equals a set number or fraction of company shares times the current share price.

Source: form-phantom-compensation-plan.pdffiller.com

Source: form-phantom-compensation-plan.pdffiller.com

Phantom stock plans also known as equity compensation plans equity pay plans stock bonus plans or phantom equity plans are a form of employee stock option plan ESOP. The Company shall take all actions necessary to terminate The Reliable Life Insurance Company Phantom Stock Bonus Plan at or prior to the Effective Time. One of the key considerations is the valuation of the business. For example if employee A were to receive 1000 shares of phantom stock with each stock worth 20 the current value of the company stock would be 20000. It depends on how the phantom stock plan is set up but they definitely can include divident payments to phantom shareholders which is a great benefit to owners of said.

Source: pinterest.com

Source: pinterest.com

A Phantom Stock Option Plan also known as a Stock Appreciation Rights SAR plan is a deferred cash bonus program that creates a similar result as a stock. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire. This Phantom Stock Agreement evidences the grant to you on the Grant Date set forth on the cover page of Phantom Stock the Phantom Stock under the 2009 Restatement of the WMS. A phantom stock plan pays a cash award to an employee that equals a set number or fraction of company shares times the current share price. One of the key considerations is the valuation of the business.

Source: pinterest.com

Source: pinterest.com

There are two main types of. A phantom stock plan pays a cash award to an employee that equals a set number or fraction of company shares times the current share price. The phantom stock plan must specify when the phantom stock payments should commence at which point a valuation of the units is generally triggered as described above. Phantom stock is considered deferred compensation and is therefore subject to Section 409A unless an exemption applies. Ad Fidelity Will Help You Manage Risk and Plan For the Future You Desire.

Source: pinterest.com

Source: pinterest.com

Phantom Stock Plans give select employees and senior management the benefit of stock ownership though without actual company stock. 11 Effective DATE the Award Date the Corporation awards to EMPLOYEE the Participant XXX shares of phantom stock the Phantom Stock valued by dividing by the closing price. As such where an exemption does not apply the payment. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The Company shall take all actions necessary to terminate The Reliable Life Insurance Company Phantom Stock Bonus Plan at or prior to the Effective Time.

Source: lexology.com

Source: lexology.com

This Phantom Stock Plan the Plan of Texas Oil Chemical Co. A phantom stock plan is a form of deferred compensation and will need to be carefully structured to avoid any adverse tax consequences to the key employee under Section 409A. There are two main types of. Phantom stock is considered deferred compensation and is therefore subject to Section 409A unless an exemption applies. This article will review and discuss the valuation issues common in designing a.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title phantom stock plan example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.