Your Salary sacrifice car scheme example quotes images are available in this site. Salary sacrifice car scheme example quotes are a topic that is being searched for and liked by netizens today. You can Find and Download the Salary sacrifice car scheme example quotes files here. Download all royalty-free images.

If you’re looking for salary sacrifice car scheme example quotes pictures information related to the salary sacrifice car scheme example quotes topic, you have visit the ideal site. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Salary Sacrifice Car Scheme Example Quotes. Included in the lease are costs for service and repairs tyres insurance and taxes. This means that instead of paying 320 or 420 in tax the individuals save these amounts on their tax bills. The difference in tax NIC and pension scheme contributions between cash pay and Salary Sacrifice. At the core is a traditional company car offered for a set period after which it goes back to the supplier.

The net pay and net delivered value of the employees pay packet. Jack is a web designer who makes an average of 82000 annually. Company Car Salary Sacrifice Scheme Example If you dont look at the wage sacrifices electric vehicles still look pretty expensive but thats where this program is good Argall says. Cycle scheme help meet green objectives. Eg - from the RAC - Prior to 2017 a salary sacrifice car scheme carried the same tax advantages as other salary sacrifice schemes however since April 2017 the employee is now required to pay income tax on either the value of the car or the amount of salary sacrificed. Apr 10 2021.

This means the only cost to you will be the salary deduction based on the monthly lease cost of the vehicle.

Apr 10 2021. We were set up to design electric car salary sacrifice schemes from the ground up from a HR perspective as a benefit. The salary sacrifice car is used as a private car but is leased by the employer usually for 36 months. Seems that we have a salary sacrifice scheme through Tusker where you can lease a car including insurance and maintenance costs pre-tax. The first thing to be aware of is salary sacrifice cars are essentially business contract hire cars packaged into an HMRC compliant scheme. Find out what.

You are tied into an agreement for 3 years and at the end of the agreement you can either give the car back get another vehicle or buy the current car. With a salary sacrifice arrangement the 1000 is used to pay for a cycle to work voucher and it is no longer taxable. Children care vouchers get people back to work so they can pay tax. Fleet Funding and Taxation 202021 our annual report written in association with Deloitte. Cycle scheme help meet green objectives.

Source: thecarexpert.co.uk

Source: thecarexpert.co.uk

Good for your image as an attractive employer with great benefits. 26 May 2015. So i will make sure that i put 57792 per year into my pension. Seems that we have a salary sacrifice scheme through Tusker where you can lease a car including insurance and maintenance costs pre-tax. The net pay and net delivered value of the employees pay packet.

Source: wevee.uk

Source: wevee.uk

If my employer puts 7 of my salary into a pension. The difference in tax NIC and pension scheme contributions between cash pay and Salary Sacrifice. Assuming you have been in the 1995 pension scheme you can find this out from your TRS or annual benefit statement for 24 years this would equate to 2480th x 8253 2476 of pension growth. Electric car salary sacrifice scheme As announced in the 2020 budget electric cars are the most beneficial to obtain via a salary sacrifice because they attract no BIK in the 202021 tax year. Good for your image as an attractive employer with great benefits.

Source: heraldscotland.com

Source: heraldscotland.com

The adjustment to pay required to get a car under Salary Sacrifice. This means the only cost to you will be the salary deduction based on the monthly lease cost of the vehicle. I will be saving 289pm by paying for the car from gross pay. Further increasing the attractiveness of getting a new vehicle via a salary sacrifice scheme. You are tied into an agreement for 3 years and at the end of the agreement you can either give the car back get another vehicle or buy the current car.

Source: twitter.com

Source: twitter.com

Employees must agree to salary sacrifice schemes and therefore they should be written into employment. I will be saving 289pm by paying for the car from gross pay. Electric car salary sacrifice scheme As announced in the 2020 budget electric cars are the most beneficial to obtain via a salary sacrifice because they attract no BIK in the 202021 tax year. We have been providing salary sacrifice schemes for over 10 years giving us more experience than anyone else. If my employer puts 7 of my salary into a pension.

Source: fleetnews.co.uk

Source: fleetnews.co.uk

This means that instead of paying 320 or 420 in tax the individuals save these amounts on their tax bills. So i will make sure that i put 57792 per year into my pension. For electric cars the BiK rate is 0 for the 202021 financial year. Electric car salary sacrifice scheme As announced in the 2020 budget electric cars are the most beneficial to obtain via a salary sacrifice because they attract no BIK in the 202021 tax year. Jack is a web designer who makes an average of 82000 annually.

Source: hippoleasing.co.uk

Source: hippoleasing.co.uk

The net pay and net delivered value of the employees pay packet. The gross salary sacrifice in this example is 8253 when you give the car back your salary will go back up by 8253. Children care vouchers get people back to work so they can pay tax. We work with hundreds of organisations from large utilities to the National Health Service to offer employees a benefit-rich salary sacrifice car scheme. Electric car salary sacrifice scheme As announced in the 2020 budget electric cars are the most beneficial to obtain via a salary sacrifice because they attract no BIK in the 202021 tax year.

Source: thisismoney.co.uk

Source: thisismoney.co.uk

The difference in tax NIC and pension scheme contributions between cash pay and Salary Sacrifice. The actual amount will depend on which costs the employer wishes to take in to account. The adjustment to pay required to get a car under Salary Sacrifice. Cycle scheme help meet green objectives. If you get an electric vehicle then your BIK costs are.

Source: wevee.uk

Source: wevee.uk

Good for your image as an attractive employer with great benefits. Assuming you have been in the 1995 pension scheme you can find this out from your TRS or annual benefit statement for 24 years this would equate to 2480th x 8253 2476 of pension growth. Our scheme is the lowest admin slickest scheme on the market and since 2011 when we implemented the UKs first electric vehicle salary sacrifice scheme weve been pioneering a unique approach to make our schemes accessible. 26 May 2015. Prior to 2017 a salary sacrifice car scheme carried the same tax advantages as other salary sacrifice schemes however since April 2017 the employee is now required to pay income tax on either the value of the car or the amount of salary sacrificed.

Source: loveelectric.cars

Source: loveelectric.cars

The car scheme is there to boost car industry by getting more people in cars. 688 x 12 x 007 57792 less per year will go into my pension. The adjustment to pay required to get a car under Salary Sacrifice. We have been providing salary sacrifice schemes for over 10 years giving us more experience than anyone else. Apr 10 2021.

Source: hippoleasing.co.uk

Source: hippoleasing.co.uk

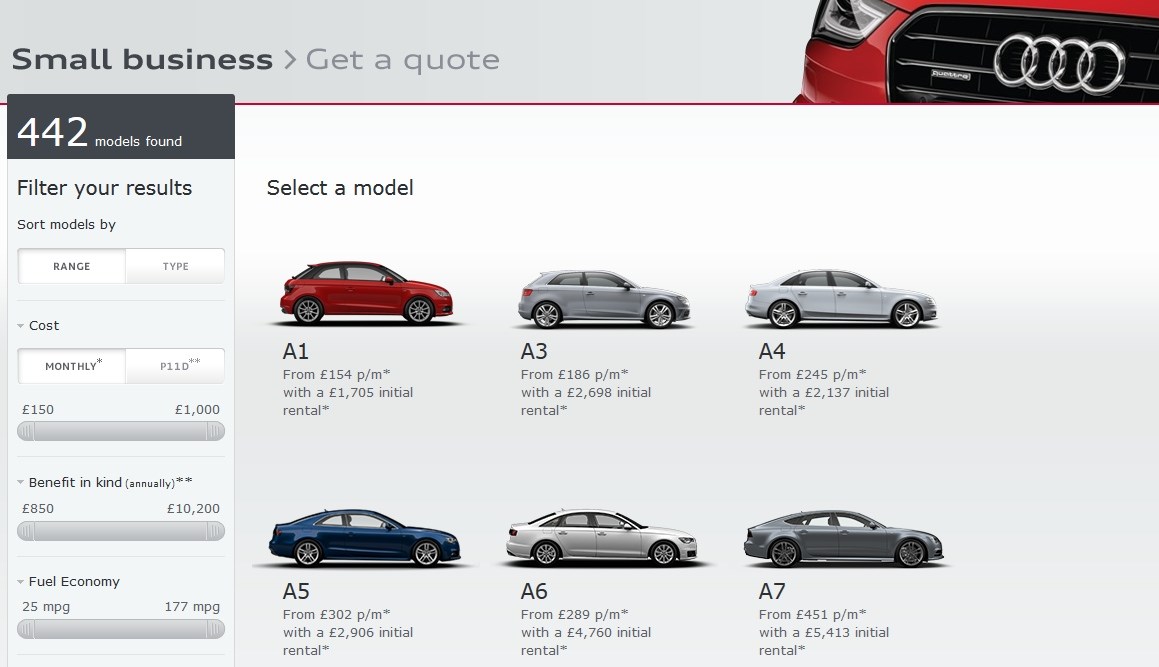

Salary sacrifice car schemes 4 key questions if youre a business owner fleet manager or HR manager these are the four things to think about if youre interested in setting up a salary sacrifice scheme. At the core is a traditional company car offered for a set period after which it goes back to the supplier. To illustrate how acquiring a car through salary sacrifice works consider the following salary sacrifice car examples. Salary Sacrifice does not have to be offered to all employees which answers my original question. Salary sacrifice car schemes 4 key questions if youre a business owner fleet manager or HR manager these are the four things to think about if youre interested in setting up a salary sacrifice scheme.

Source: heraldscotland.com

Source: heraldscotland.com

He has never heard of salaray packaging or novated leasing and acquires a Toyota Yaris through a normal lease agreement. Included in the lease are costs for service and repairs tyres insurance and taxes. He has never heard of salaray packaging or novated leasing and acquires a Toyota Yaris through a normal lease agreement. Good for your image as an attractive employer with great benefits. 688 x 12 x 007 57792 less per year will go into my pension.

Source: worldevday.org

Source: worldevday.org

Electric car salary sacrifice scheme As announced in the 2020 budget electric cars are the most beneficial to obtain via a salary sacrifice because they attract no BIK in the 202021 tax year. Prior to 2017 a salary sacrifice car scheme carried the same tax advantages as other salary sacrifice schemes however since April 2017 the employee is now required to pay income tax on either the value of the car or the amount of salary sacrificed. If you get an electric vehicle then your BIK costs are. The company I work for has just released a salary sacrifice car scheme whereby I surrender a portion of my monthly salary for the lease of a car. This means the only cost to you will be the salary deduction based on the monthly lease cost of the vehicle.

Source: parkers.co.uk

Source: parkers.co.uk

The salary sacrifice calculator aims to illustrate how such schemes work from both the employees and employers perspective and assuming a neutral impact on the employer. We were set up to design electric car salary sacrifice schemes from the ground up from a HR perspective as a benefit. Our scheme is the lowest admin slickest scheme on the market and since 2011 when we implemented the UKs first electric vehicle salary sacrifice scheme weve been pioneering a unique approach to make our schemes accessible. Fleet Funding and Taxation 202021 our annual report written in association with Deloitte. The salary sacrifice calculator aims to illustrate how such schemes work from both the employees and employers perspective and assuming a neutral impact on the employer.

Source: wevee.uk

Source: wevee.uk

We were set up to design electric car salary sacrifice schemes from the ground up from a HR perspective as a benefit. Salary Sacrifice does not have to be offered to all employees which answers my original question. The gross salary sacrifice in this example is 8253 when you give the car back your salary will go back up by 8253. Good for your image as an attractive employer with great benefits. We have been providing salary sacrifice schemes for over 10 years giving us more experience than anyone else.

Source: hitachicapitalvehiclesolutions.co.uk

Source: hitachicapitalvehiclesolutions.co.uk

The UKs leading independent fleet management provider and private sector salary sacrifice for cars scheme provider. We work with hundreds of organisations from large utilities to the National Health Service to offer employees a benefit-rich salary sacrifice car scheme. Salary Sacrifice Car Example. 688 x 12 x 007 57792 less per year will go into my pension. As part of a payroll sacrifice system you can make an.

Source: parkers.co.uk

Source: parkers.co.uk

With the help of a salary sacrifice scheme employees can lease an EV and therefore save a significant amount on the monthly cost - up to 50 in fact. 688 x 12 x 007 57792 less per year will go into my pension. With a salary sacrifice arrangement the 1000 is used to pay for a cycle to work voucher and it is no longer taxable. There will be a BIK tax 2 from the 202223 tax year but the employee is benefiting from reduced tax and NI and the business reduced ENI CTX and 50 of the input VAT can be claimed back. Salary Sacrifice does not have to be offered to all employees which answers my original question.

Source: vimcar.co.uk

Source: vimcar.co.uk

He has never heard of salaray packaging or novated leasing and acquires a Toyota Yaris through a normal lease agreement. To illustrate how acquiring a car through salary sacrifice works consider the following salary sacrifice car examples. If my employer puts 7 of my salary into a pension. With a salary sacrifice arrangement the 1000 is used to pay for a cycle to work voucher and it is no longer taxable. You are tied into an agreement for 3 years and at the end of the agreement you can either give the car back get another vehicle or buy the current car.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title salary sacrifice car scheme example quotes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.