Your Vat reverse charge invoice example images are ready. Vat reverse charge invoice example are a topic that is being searched for and liked by netizens today. You can Download the Vat reverse charge invoice example files here. Find and Download all free photos and vectors.

If you’re looking for vat reverse charge invoice example pictures information related to the vat reverse charge invoice example interest, you have come to the ideal site. Our site always provides you with hints for seeking the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

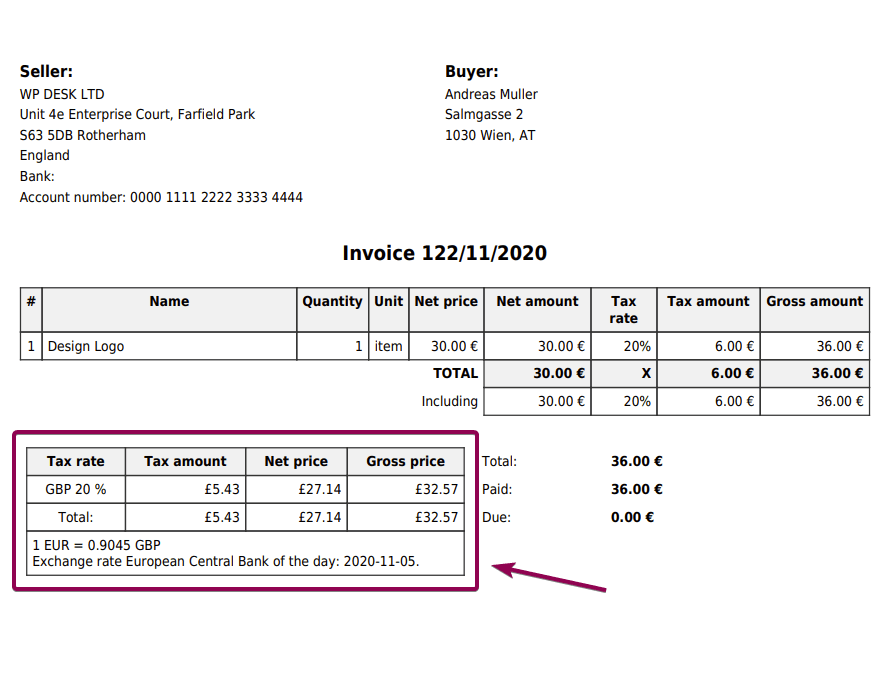

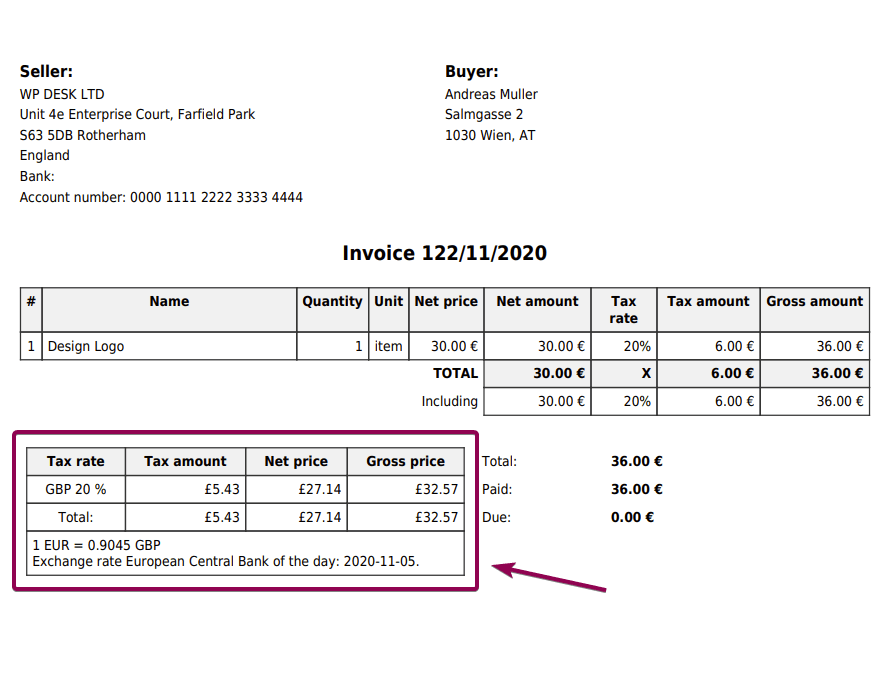

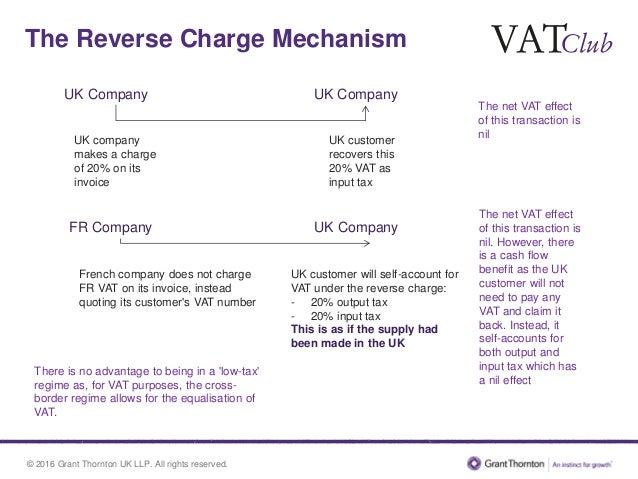

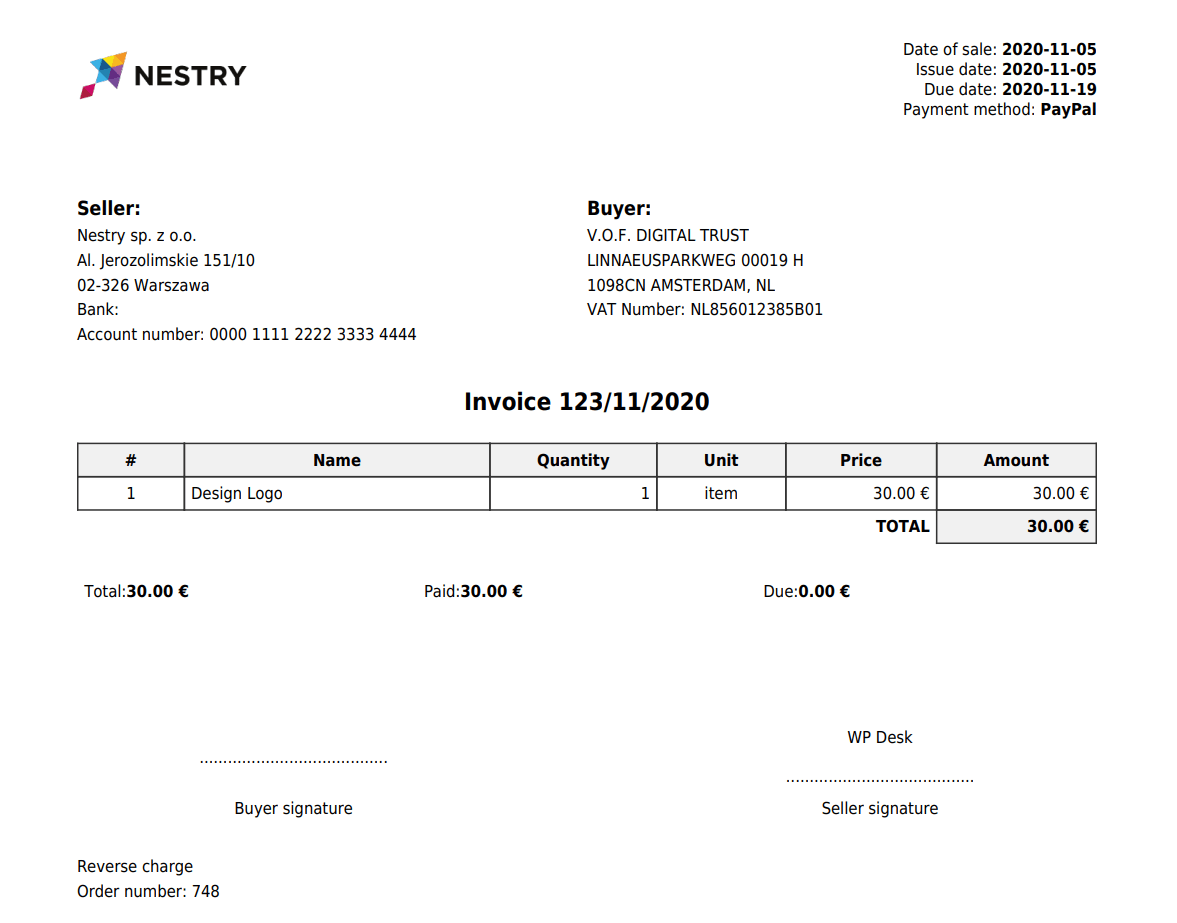

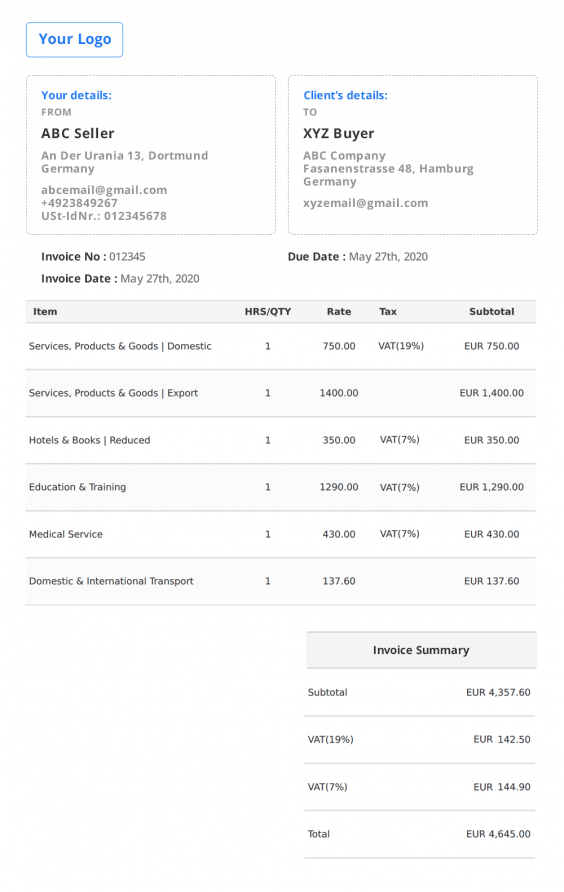

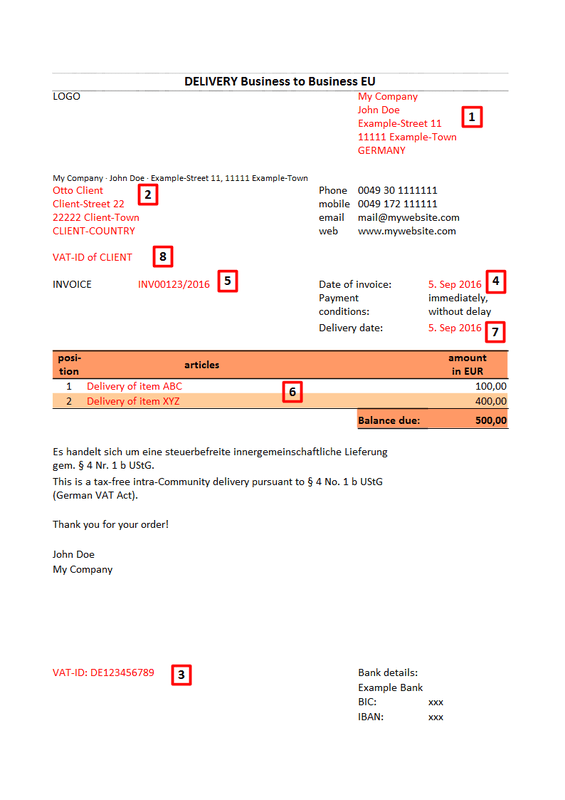

Vat Reverse Charge Invoice Example. Example of a reverse charge invoice for one contract with different VAT rates. In this scenario the tax liability is reversed and. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice.

Eu Vat Invoice Checker Flexible Invoices From flexibleinvoices.com

Eu Vat Invoice Checker Flexible Invoices From flexibleinvoices.com

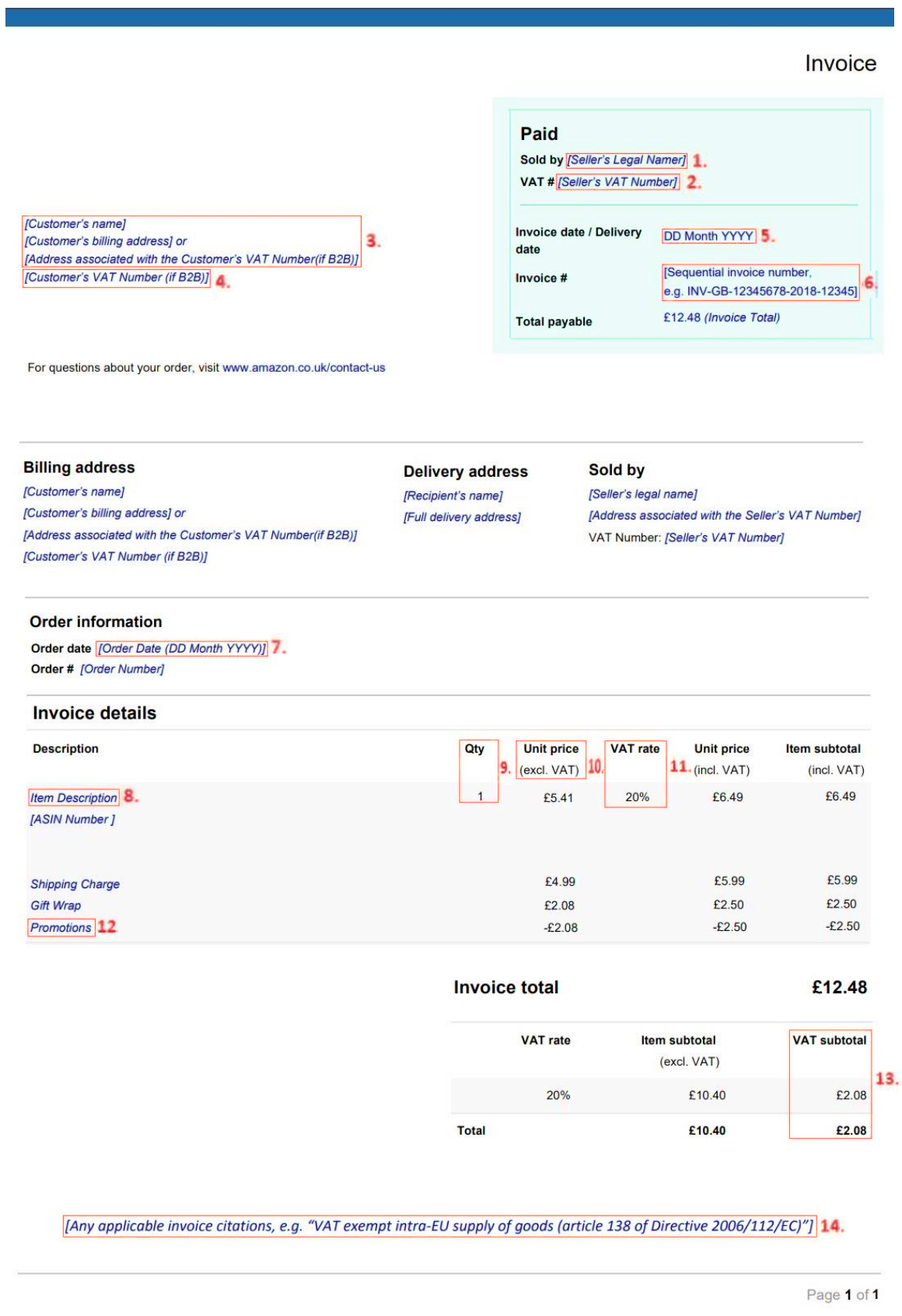

The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns. This is non-reverse charge work as the contractor is the end-user. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge. The default invoice template is Invoice Template. The article offers several samples of VAT invoice templates such ash reverser.

The article offers several samples of VAT invoice templates such ash reverser.

The reverse charge mechanism is a deviation from this rule where the supplier. Reverse Charge Invoice Format. This must now pay the VAT due on the service amount to. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. Customer to account to HMRC for the reverse charge output tax. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale.

Source: in.pinterest.com

Source: in.pinterest.com

Invoices for services subject to the reverse charge must include the reference reverse charge according to the VAT regulations 1995. Here are some examples of approved. We identified it from reliable source. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. Reverse Charge Invoice Format.

We identified it from honorable source. The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference reverse charge. In addition you must have the VAT identification. Entering A Reverse Charge VAT Invoice. Example of reverse-charging relating to goods.

Source: flexibleinvoices.com

Source: flexibleinvoices.com

A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. Recipient is liable for VAT. VAT Act 1994 Section 55A applies The second problem is a cashflow. We identified it from reliable source. Example of reverse-charging relating to goods.

Source: support.geekseller.com

Source: support.geekseller.com

The end-user of goods or services will receive a reverse charged value-added tax on its invoice. Reverse Charge Vat Invoice Example. The VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. A reverse VAT invoice is issued in special cases where transactions are subject to the VAT reverse charge mechanism.

Source: jttaccounts.co.uk

Source: jttaccounts.co.uk

Reverse Charge Vat Invoice Example. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge. The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference reverse charge. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. This end-user suppose a retailer would include the value-added tax amount to its products.

The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. The HMRC example is as follows. We identified it from honorable source. Invoices for services subject to the reverse charge must include the reference reverse charge according to the VAT regulations 1995. Reverse Charge Invoice Format.

Source: pinterest.com

Source: pinterest.com

The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. The VAT regulations 1995 say invoices for services subject to the reverse charge must include the reference reverse charge. Here are some examples of approved. This is non-reverse charge work as the contractor is the end-user. Entering A Reverse Charge VAT Invoice.

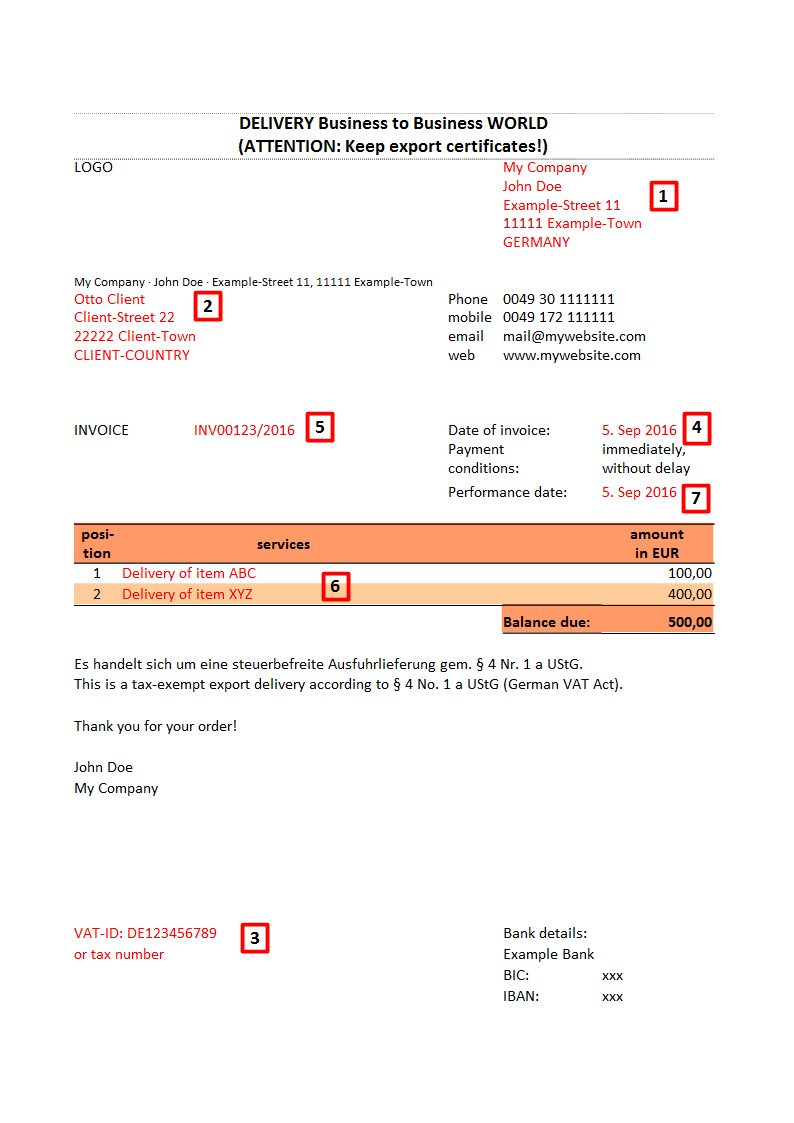

Reverse Charge Invoice Format. Reverse Charge Invoice Format. Entering A Reverse Charge VAT Invoice. The article offers several samples of VAT invoice templates such ash reverser. You are a German entrepreneur you have goods in Rotterdam and you supply these to an entrepreneur established in the Netherlands.

Source: slideshare.net

Source: slideshare.net

Entering A Reverse Charge VAT Invoice. The reverse charge mechanism is a deviation from this rule where the supplier. In this scenario the tax liability is reversed and. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge.

Source: pinterest.com

Source: pinterest.com

Example of reverse-charging relating to goods. If you are a VAT-registered contractor customer you will instead account for both. However when business occurs between two businesses that are based in two different EU countries a reverse charge applies. A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. For many businesses understanding how a reverse charge VAT.

Source: flexibleinvoices.com

Source: flexibleinvoices.com

As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. This is non-reverse charge work as the contractor is the end-user. The reverse charge mechanism is a deviation from this rule where the supplier. Recipient is liable for VAT. The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice.

Here are a number of highest rated Reverse Charge Invoice Format pictures upon internet. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge. A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. VAT Act 1994 Section 55A applies The second problem is a cashflow.

Source: asset-temple.com

Source: asset-temple.com

A disclaimer outlining that the reverse charge applies to items marked with Domestic reverse charge and that customers need to account for VAT on these items to HMRC at the rate. The end-user of goods or services will receive a reverse charged value-added tax on its invoice. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. We identified it from honorable source. Example of reverse-charging relating to goods.

Source: ordeconta.com

Source: ordeconta.com

Here are a number of highest rated Reverse Charge Invoice Format pictures upon internet. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. This end-user suppose a retailer would include the value-added tax amount to its products. Here are a number of highest rated Reverse Charge Invoice Format pictures upon internet. Here are a number of highest rated Reverse Charge Vat Invoice Example pictures upon internet.

Source: freeinvoicebuilder.com

Source: freeinvoicebuilder.com

As a general rule businesses charge VAT on supplies and deduct VAT on purchases. As a general rule businesses charge VAT on supplies and deduct VAT on purchases. When you select Type 2 Invoice Layout in Sales Invoices Invoice Template 1 is used. The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. The invoice must now state that reverse charge applies.

The reverse charge label is added to ensure that the buyer is aware that they need to account for the VAT on the sale. You are a German entrepreneur you have goods in Rotterdam and you supply these to an entrepreneur established in the Netherlands. Invoices for services subject to the reverse charge must include the reference reverse charge according to the VAT regulations 1995. If you are a VAT-registered contractor customer you will instead account for both. As we mentioned in the earlier example the reverse charge means that the recipient rather than the provider is responsible for accounting for VAT on their VAT returns.

Source: ordeconta.com

Source: ordeconta.com

Example of reverse-charging relating to goods. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge. Example of a reverse charge invoice for one contract with different VAT rates. As the reverse charge work is 476 of the total invoice value 500 10500 you need to charge 20 VAT on the whole. If you are a VAT-registered contractor customer you will instead account for both.

Source: eque2.co.uk

Source: eque2.co.uk

You are a German entrepreneur you have goods in Rotterdam and you supply these to an entrepreneur established in the Netherlands. As a general rule businesses charge VAT on supplies and deduct VAT on purchases. Therefore the invoice of the translator has to contain a phrase like Reverse-Charge. Entering A Reverse Charge VAT Invoice. The default invoice template is Invoice Template.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title vat reverse charge invoice example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.